Wondering if your insurance will cover acupuncture? The short answer is: probably, but it's all in the details. While patients once had to pay for acupuncture entirely out of pocket, it’s now a much more common, insurance-covered therapy, especially for managing chronic pain.

The Evolving Landscape of Acupuncture Coverage

For years, insurers considered acupuncture an “alternative” treatment, which meant patients had to foot the entire bill. That landscape has changed dramatically. A growing mountain of clinical evidence and a powerful patient-led demand for non-drug pain solutions have pushed insurers to take notice.

This shift is part of a much larger trend toward integrative medicine, an approach that thoughtfully combines conventional medical treatments with evidence-based complementary therapies. You can dive deeper into what integrative medicine entails in our detailed article.

What’s Driving the Change?

The expansion of insurance coverage for acupuncture isn't happening by accident. It's the result of a few key developments coming together at the right time.

- Solid Clinical Evidence: Study after study continues to prove acupuncture’s effectiveness for specific conditions, giving insurers the hard data they need to justify adding it to their plans.

- Strong Patient Demand: More people than ever are seeking effective, non-opioid options for pain management, and they're making their voices heard. Insurers have had to adapt to keep up.

- It’s Cost-Effective: For some conditions, a course of acupuncture is simply cheaper in the long run than years of prescription medications or invasive surgeries. For health plans, that’s a compelling financial argument.

A major turning point came in 2020 when Medicare Part B finally started covering acupuncture for chronic low back pain. Decisions like that from Medicare have a ripple effect, often prompting private insurers to follow suit.

Many major insurance companies have since broadened their acupuncture benefits. Heading into 2025, it’s common to see carriers like Aetna, Cigna, and UnitedHealthcare offer plans that cover roughly 12 sessions per year for conditions like chronic pain that has lasted over six months.

Even with all this progress, the coverage details can vary wildly from one plan to the next. The first and most important step is to understand exactly what your specific plan covers. That knowledge empowers you to use your benefits confidently on your path to better health.

What Conditions Do Insurers Typically Cover?

Here’s the most important thing to understand about getting your acupuncture covered: insurance carriers don't see it as a general wellness treatment. They view it as a specific medical intervention, which means your insurance coverage for acupuncture boils down to one critical term: medical necessity.

To an insurer, this means they need a formal diagnosis to justify paying for your sessions. Each treatment must be directly linked to a recognized health problem. Think of it like getting a prescription from your doctor—they prescribe medication for a specific illness, not just for "feeling better." In the same way, an insurer approves acupuncture for a diagnosed condition like chronic low back pain, not just for general stress relief. This is why having that diagnosis in hand is the essential first step.

Conditions Most Likely to Get Approved

While every policy has its quirks, a clear pattern has emerged among the major insurance companies. They tend to prioritize conditions where strong clinical evidence shows acupuncture is an effective—and often cost-saving—alternative to long-term medications or more invasive procedures. Your claim stands the best chance when your condition falls into one of these well-documented categories.

Here are the conditions that insurers most often cover:

- Chronic Low Back Pain: This is the big one. After Medicare began covering acupuncture for chronic low back pain, nearly every private insurer followed suit. Coverage typically applies to pain that has lasted 12 weeks or longer.

- Migraine and Tension-Type Headaches: There's a mountain of evidence showing acupuncture can reduce the frequency and severity of headaches, making it a widely accepted treatment.

- Knee Osteoarthritis: Insurers often cover acupuncture to help manage pain and improve mobility, seeing it as a way to potentially delay or even prevent costly knee replacement surgery.

- Chemotherapy-Induced Nausea and Vomiting (CINV): Many plans will cover acupuncture as an adjunctive therapy, helping cancer patients better tolerate the debilitating side effects of their primary treatment.

- Neck Pain: Much like back pain, chronic neck pain is another condition that is frequently included in insurance plans.

An insurer's decision-making always comes down to risk and cost. When reputable studies show that acupuncture can prevent an expensive surgery or reduce a patient's reliance on pricey long-term prescriptions, approving coverage simply becomes a good financial move.

How Evidence Shapes Your Coverage

The list of covered conditions isn't arbitrary. It’s built on a solid foundation of scientific research that shows where acupuncture works best. For example, numerous studies have confirmed acupuncture's effectiveness for issues like low back pain, and those findings directly influence insurance policies. Insurers lean heavily on this data to build their internal medical guidelines.

This evidence-based approach is exactly why coverage for acupuncture for chronic pain is far more common today than it was a decade ago. It also means that as new research validates acupuncture for other conditions, the list of what insurers are willing to cover will likely continue to grow. When you understand this logic, you can better frame your treatment needs in a language that aligns with your insurer's criteria, which is a key step toward getting your claim approved.

How Your Insurance Plan Type Affects Coverage

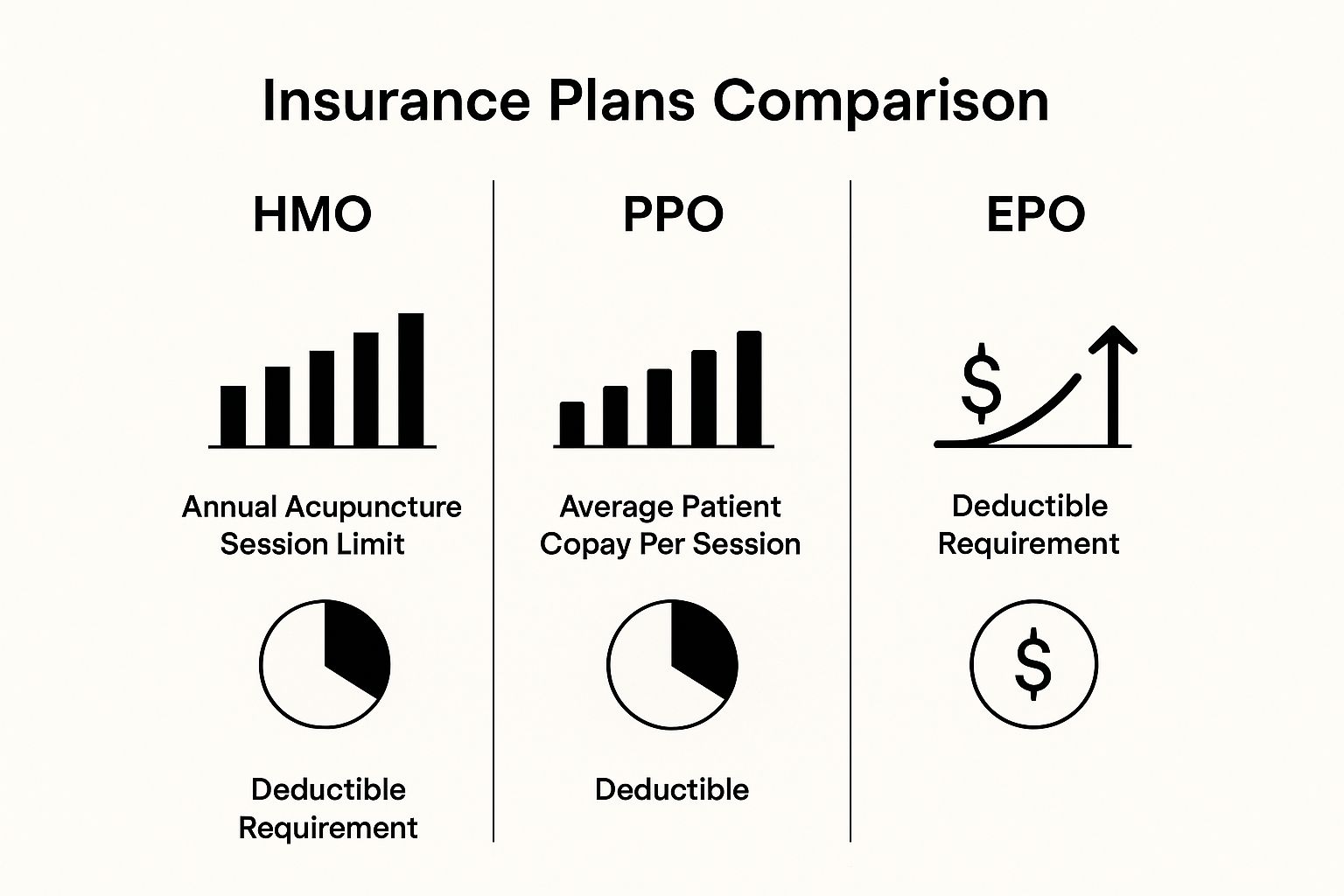

Those acronyms on your insurance card—HMO, PPO, EPO—are a lot more than just alphabet soup. They're the rulebook for how you get to use your health benefits, and they play a huge role in determining your insurance coverage for acupuncture. Your plan type dictates everything from which acupuncturists you can see to what you'll actually pay for each session.

HMO, PPO, EPO: What's the Difference for Acupuncture?

Think of an HMO (Health Maintenance Organization) plan like a guided tour. It's often more affordable, but it comes with a set itinerary. To see a specialist like an acupuncturist, you'll almost always need a referral from your Primary Care Physician (PCP). Plus, you have to stay strictly within the plan’s network of approved providers. Going outside that network usually means you're footing the entire bill yourself.

A PPO (Preferred Provider Organization), on the other hand, is more like having an open-ended travel pass. It gives you a ton of freedom. You can typically see a specialist without a referral, and you have the choice to see providers both inside and outside the network. That flexibility comes at a price, though—your copays, coinsurance, and deductibles tend to be higher, especially if you venture out-of-network.

Then there's the EPO (Exclusive Provider Organization), which is a bit of a hybrid. Like a PPO, you generally don't need a referral to see a specialist. But, like an HMO, you're locked into an "exclusive" network of providers. There's no coverage for out-of-network care, except in true emergencies.

The table below breaks down these key differences at a glance, helping you see how your plan might handle acupuncture services.

Acupuncture Coverage by Insurance Plan Type

| Plan Type | Referral Required | In-Network Coverage | Out-of-Network Coverage |

|---|---|---|---|

| HMO | Almost always | Yes, with approved providers | Generally no coverage |

| PPO | Usually not required | Yes, typically with lower cost-share | Yes, but at a higher cost-share |

| EPO | Usually not required | Yes, with approved providers | Generally no coverage |

As you can see, each plan structure forces you to weigh cost against freedom of choice. Understanding where your plan falls on this spectrum is the first step to figuring out your coverage.

As the infographic highlights, while a PPO might give you more choices, it could also mean higher deductibles. An HMO might limit your sessions but keep your out-of-pocket costs lower for each visit.

Using Tax-Advantaged Accounts for Acupuncture

What if your insurance doesn't cover acupuncture, or the coverage is pretty limited? Don't worry, you still have some great options for making treatments more affordable. Tax-advantaged accounts are a fantastic way to pay for care using pre-tax dollars.

-

Health Savings Account (HSA): If you have a high-deductible health plan (HDHP), you may be eligible for an HSA. Think of it as a personal savings account just for healthcare. The money is yours, it never expires, and it rolls over year after year.

-

Flexible Spending Account (FSA): Many employers offer FSAs as part of their benefits package. You contribute a portion of your paycheck pre-tax to this account to cover medical expenses. The main catch is that FSA funds are usually "use-it-or-lose-it," meaning you have to spend the money within the plan year.

Key Takeaway: The IRS considers acupuncture a qualified medical expense. This is great news because it means you can use your HSA or FSA debit card to pay for your sessions, needles, and even prescribed herbal formulas. You're essentially giving yourself a discount equal to your income tax rate.

By getting a handle on your plan's structure and knowing how to use tools like an HSA or FSA, you can map out a clear financial path for your treatment. This empowers you to get the care you need without any surprise bills along the way.

A Step-By-Step Guide to Verifying Your Benefits

There's nothing worse than getting a surprise bill in the mail. The single best thing you can do to avoid that financial stress is to proactively verify your insurance coverage for acupuncture before your first appointment. Think of it as creating a clear financial roadmap for your treatment.

This one step puts you in the driver's seat, so you know exactly what to expect. While your acupuncturist's office might offer to do this for you, doing it yourself means you get the information straight from the source.

Preparing for the Call

Before you pick up the phone, a little prep work goes a long way. Having a few key items on hand will make the whole process smoother and much faster.

You’ll want to have these things ready:

- Your insurance card (you'll need info from the front and back)

- A pen and paper (or a digital doc) to jot down notes

- The full name and date of birth of the main person on the policy

Flip over your insurance card and look for the "Member Services" or "Customer Service" phone number. That's your direct line to a representative who can pull up your specific plan details.

Don’t just get answers—get proof. At the end of the call, always ask the representative for a call reference number. This little number is your official record of the conversation, and it can be a lifesaver if a claim gets denied or questioned down the road.

Questions to Ask the Insurance Representative

Once you're connected, asking the right questions is everything. Vague questions get vague answers, so you need to be specific to get a complete picture of what’s covered.

Use this checklist to guide the conversation and make sure you don't miss any important details:

- Does my specific plan cover acupuncture services? This is the first and most important question. If the answer is no, you can shift to asking about out-of-network options or using an HSA/FSA.

- Are there any specific conditions or diagnoses required for coverage? As we've covered, insurers need to see medical necessity. Ask if your diagnosis—like chronic low back pain or migraines—is on their approved list.

- Do I need a referral from my doctor or pre-authorization? This is a huge one, especially for HMO plans. Missing this step is a common reason for automatic claim denials.

- How many sessions am I covered for per calendar year? Most plans set a limit, often between 12 and 20 sessions. Knowing this number helps you and your acupuncturist map out an effective treatment schedule.

- What will my share of the cost be? Get specific here. Ask about your deductible, copay, and coinsurance for acupuncture. It's also smart to ask how much of your annual deductible you've already met. To get a better sense of what these costs might look like, check out our guide on https://drerictsai.com/f/%F0%9F%A7%8D%E2%80%8D%E2%99%82%EF%B8%8Feric-tsai-lac-msaom-bpharm#44cae461-999c-4ec1-82f4-fe3dbdc25492/how-much-does-acupuncture-cost.

- Do I need to see an in-network provider? Find out if your plan is an HMO or a PPO and what the cost difference is for seeing an out-of-network acupuncturist. Sometimes the flexibility is worth it, but you need to know the numbers first.

When you're confirming your benefits, it's also helpful to be aware of regulations designed to shield you from unexpected medical bills. A great resource is understanding protections under the No Surprises Act. Taking these steps turns confusion into confidence, letting you focus on what really matters: your health.

Why Medical Coding Is the Linchpin of Your Claims

Behind every single insurance claim—whether it's approved in a flash or denied on the spot—is a set of specific medical codes. You can think of these codes as a specialized language that allows your acupuncturist to tell the insurance company exactly what's wrong and what they did to help.

If that code is wrong, incomplete, or just a little too vague, it can trigger an automatic denial. This happens even if the treatment was absolutely necessary for your health.

This coding system gets everyone on the same page. For instance, instead of just jotting down "sore lower back," your practitioner uses a highly specific code that details the diagnosis, the exact location of the pain, and whether it’s a new or chronic issue. That's the level of detail insurance companies require to process a claim correctly.

The Role of Diagnosis Codes

The main codes used here come from the International Classification of Diseases (ICD). This coding framework is the bedrock for proving that "medical necessity" we talked about earlier. Without a proper diagnosis code, your claim simply has no leg to stand on.

A huge update to this system came with the World Health Organization's ICD-11, which went into effect in February 2022. This wasn't just a minor tweak; it introduced a modern framework with over 120,000 codes to classify just about every health condition and procedure imaginable, including new codes specifically for acupuncture.

In the United States, using these precise codes is what enables smooth communication between your provider and your insurer, making sure your claim for insurance coverage for acupuncture is handled the right way. You can learn more about how these new codes improve acupuncture billing on the SCUHS website.

This is exactly why giving your acupuncturist a complete and honest health history is so critical. The little details you share are what guide them to the right codes, which ultimately decides whether your claim glides through the system or gets bogged down in delays.

Your detailed health history is the raw material your acupuncturist uses to select the correct medical codes. The more accurate your information, the stronger and more precise your insurance claim will be.

As medical coding gets more and more intricate, new tools are emerging to help ensure accuracy. It's worth exploring the role of AI in medical coding to see how technology is helping to improve the claims process.

Now, nobody expects you to become a certified medical coder overnight. But understanding why it matters makes you a better advocate for your own healthcare.

When you provide clear, detailed information, you're giving your practitioner the tools they need to build a clean, accurate claim on your behalf. That simple step dramatically boosts the odds of getting your treatment covered without a headache.

Your Top Questions About Acupuncture Insurance, Answered

Let's be honest: navigating insurance for acupuncture can feel like you're trying to decipher a secret code. Even after you've done your homework and verified your benefits, a few tricky questions always seem to pop up. These are the real-world situations that can cause headaches just when you're ready to focus on your health.

We’ve been there, and we've helped countless patients through it. Here are some of the most common questions we hear, with straightforward answers to give you confidence as you move forward.

Are Different Acupuncture Techniques Covered?

One of the first questions people ask is whether their insurance will pay for more than just traditional needling. What happens when your practitioner suggests something like electroacupuncture, cupping, or moxibustion as part of your treatment plan?

The short answer is: it all comes down to your specific insurance plan and how your acupuncturist bills for those services.

- Electroacupuncture: This is a technique where a tiny, mild electrical current is passed between needles. The good news is that it’s often covered. Research has shown its use for low back pain is pretty standard, and many insurance companies see it as a natural extension of regular acupuncture.

- Cupping and Moxibustion: Coverage for these is much less certain. Insurers frequently classify them as "non-covered services." Sometimes, they're simply considered part of the main acupuncture session and aren't paid for separately.

It’s always safest to assume these additional therapies aren’t covered until you hear otherwise. A good first step is to ask your acupuncturist's office how they handle billing for these treatments. If you want to be 100% sure, a quick call to your insurance provider will clear things up.

Before you agree to any supplementary treatments, get clear on the cost. Your acupuncturist should be upfront about what's included in the standard session fee and what might be an extra out-of-pocket expense.

What Happens If My Claim Is Denied?

Seeing a claim denial in the mail is incredibly frustrating, but it’s rarely the end of the road. Think of a denial as the start of a conversation. With a little persistence, many of them can be overturned.

The first thing you need to do is figure out why it was denied. Your insurance company will send you a document called an "Explanation of Benefits" (EOB) that will have a reason code. Some of the usual suspects include:

- No Pre-Authorization: Your plan might have required approval before you started treatment. If that step was missed, the claim will be rejected.

- Coding Error: Sometimes it’s just a simple typo. An incorrect diagnosis code or a data entry mistake is all it takes to trigger a denial.

- Service Not Covered: The insurer might decide that acupuncture isn't a covered benefit for your particular diagnosis.

- Visit Limit Reached: You may have simply used up all of your covered sessions for the year.

Once you have the reason, you can figure out your next move. Your acupuncturist’s office can often resolve it by resubmitting the claim with corrected codes or providing more medical records. If the denial is based on how your insurance company interprets your coverage, you have the right to file an appeal, and the process for doing so will be explained in your plan documents.

What Is a Superbill and How Do I Use It?

You might find that your preferred acupuncturist is an out-of-network provider, meaning they don't bill your insurance company directly. In that case, they'll likely give you a document called a superbill.

A superbill is basically a detailed, itemized receipt made specifically for insurance companies. It has everything your insurer needs to process a claim on your behalf: the acupuncturist’s info, your diagnosis, the specific services you received (known as procedure codes), and what you paid.

It’s then up to you to submit this superbill to your insurance company. They’ll process it based on your out-of-network benefits and mail you a check for whatever portion they cover. It does mean a little more paperwork for you, but it’s a standard way to use your benefits with a provider who isn't in your network.

Getting comfortable with these common scenarios helps you become your own best advocate. You'll know what to look out for, what questions to ask, and how to make sure you're getting the most out of the health plan you pay for.

Ready to start your journey toward pain relief and balanced health with a team that knows the ins and outs of insurance? At Eric Tsai Acupuncture and Herbs, we offer complimentary benefits verification to make your experience seamless. Let us handle the details so you can focus on healing.