The quick answer is yes, many health insurance plans now cover acupuncture, but that "yes" comes with some important caveats. It's not a universal benefit like an annual check-up. Instead, think of it as a specialized treatment that insurers approve for very specific, medically recognized conditions.

The Reality of Acupuncture Insurance Coverage Today

So, does health insurance actually cover acupuncture? The most honest answer is: it depends. The world of insurance for alternative therapies has changed a lot recently, and many more carriers are seeing the value in acupuncture, especially for managing pain.

But whether your treatment gets the green light comes down to a few key things. Your specific insurance plan, the medical diagnosis you've received, and even the state you're in all come into play. It's a complex puzzle, which means one person’s covered treatment might be another’s denial—even if they have the same insurance provider.

A Growing Acceptance, But Gaps Remain

The good news is that the trend is moving in the right direction. Recent data shows a clear shift; the percentage of acupuncturist visits paid for by insurance jumped from 41.1% in 2010 to 50.2% by 2019. This tells us that insurance companies are becoming much more willing to reimburse for these treatments.

However, there's another side to that statistic. During that same period, patients still paid for more than half of all costs out-of-pocket. This highlights a crucial point: even when your plan does cover acupuncture, it might not be a 100% deal. For a deeper dive, you can explore the full study detailing these insurance trends.

Here's the most important takeaway: Never assume your acupuncture treatment is covered. The single best thing you can do is verify your benefits directly with your insurer before your first appointment. This simple step can save you from a lot of unexpected bills down the road.

To give you a better sense of what to expect, it helps to look at some of the most common situations. Understanding where coverage is likely versus where it’s a long shot will help you set realistic expectations and navigate the process with confidence.

The table below offers a quick summary of how insurance carriers often view acupuncture claims.

A Quick Look at Acupuncture Coverage Scenarios

| Coverage Scenario | Likelihood of Coverage | Commonly Covered Conditions |

|---|---|---|

| Medically Necessary Pain | High | Chronic Low Back Pain, Neck Pain, Osteoarthritis of the Knee |

| Wellness or General Health | Low | Stress Reduction, General Well-being, Preventative Care |

| Specific Diagnoses | Varies | Nausea from Chemotherapy, Headaches/Migraines |

| Other Conditions | Very Low | Fertility Treatments, Anxiety, Smoking Cessation |

As you can see, the "why" behind your treatment is everything to an insurer. A claim for a well-documented pain condition has a much better chance of approval than one for general wellness.

Which Health Plans Are Most Likely to Cover Acupuncture

Figuring out if your insurance will pay for acupuncture can feel like a maze. Some health plans are much more welcoming to alternative therapies than others, and knowing where to look first can save you a ton of headaches.

As a general rule, you’ll find that PPO (Preferred Provider Organization) plans give you more wiggle room. They're typically more likely to cover acupuncture than the more rigid HMO (Health Maintenance Organization) plans, which often keep you locked into a tight network and demand referrals for everything.

Major Private Insurers

When you dive into the world of private insurance, you'll see a lot of variation from one company to the next. Some are ahead of the curve, while others are still playing catch-up.

- UnitedHealthcare, Cigna, and Blue Shield/Anthem tend to be the most progressive carriers. They often include coverage for specific conditions like chronic pain, headaches, or nausea. Just be aware that they almost always cap the number of visits per year.

- Aetna and Kaiser Permanente also provide acupuncture benefits, but their policies can be a bit more restrictive. Kaiser, for instance, usually insists you see an acupuncturist within their own network, and getting a referral first is common practice.

Remember, even with these well-known insurers, coverage is never a given. It all comes down to the fine print in your specific plan and whether your treatment is deemed a medical necessity. If you're dealing with ongoing discomfort, it's worth exploring our guide on using acupuncture for chronic pain.

Government and Marketplace Plans

In recent years, government plans have made some real progress. The biggest news came in 2020 when Medicare started covering acupuncture for chronic low back pain. This was a game-changing decision that pushed many private insurance companies to rethink their own policies.

Medicare's coverage was a major step forward, but the details matter. They limit you to 12 visits in 90 days. You might get an additional 8 sessions, but only if you're showing clear signs of improvement.

Affordable Care Act (ACA) plans, sold on the marketplace, are a mixed bag. Coverage really depends on where you live. In states like California and Washington, acupuncture is classified as an Essential Health Benefit, so most plans sold there have to cover it. In other states, it’s just an optional add-on that many plans skip. This state-by-state variance is a huge piece of the puzzle.

How Your State Can Change Your Coverage Entirely

You might think your insurance plan is the final word on what's covered, but that’s only half the story. The state you live in sets the "rules of the road" that insurance carriers must follow. This is why the answer to does health insurance cover acupuncture can depend so heavily on your zip code.

It’s a strange but true reality of the American healthcare system. Two people can have the exact same plan from a major national carrier, like Cigna or UnitedHealthcare, yet have completely different experiences. One person might get their treatments covered without a hitch, while the other faces a denial—all because they live across a state line.

States With Stronger Coverage Mandates

Some states have stepped up, passing laws that require insurers to provide acupuncture benefits. These state mandates are a huge win for residents seeking alternative care.

For example, states like Alaska, California, Maryland, New Mexico, and Washington have designated acupuncture as an Essential Health Benefit under the Affordable Care Act (ACA). This means that if you buy a benchmark plan on the marketplace in one of these states, it must include coverage for certain acupuncture services. You can get a more detailed breakdown by reading about how state-level policies influence acupuncture coverage.

This geographic lottery is one of the most significant—and most confusing—factors in acupuncture insurance. Your location can be just as crucial as your diagnosis or the specific plan you chose.

Other states, such as Ohio and Oregon, have broadened their Medicaid programs to include acupuncture for conditions like chronic pain. As more people look for non-pharmaceutical options, knowing your local laws becomes essential. If you're looking into ways to handle persistent pain, our guide on 10 essential chronic pain treatment options might offer some valuable insights. A little research into your state’s rules can make all the difference in getting the care you need.

Your Step-by-Step Guide to Verifying Benefits

Knowing your plan might cover acupuncture is one thing, but getting a straight answer from your insurance company is a whole different ballgame. To get beyond the fine print and find out what’s actually covered, you need a clear, methodical approach. This simple guide will help you cut through the confusion and know exactly where you stand before booking your first appointment.

The most reliable way to get answers is to pick up the phone. Grab your insurance card, find the member services phone number on the back, and get ready to ask some pointed questions. Simply asking "do you cover acupuncture?" isn't enough—the devil is truly in the details.

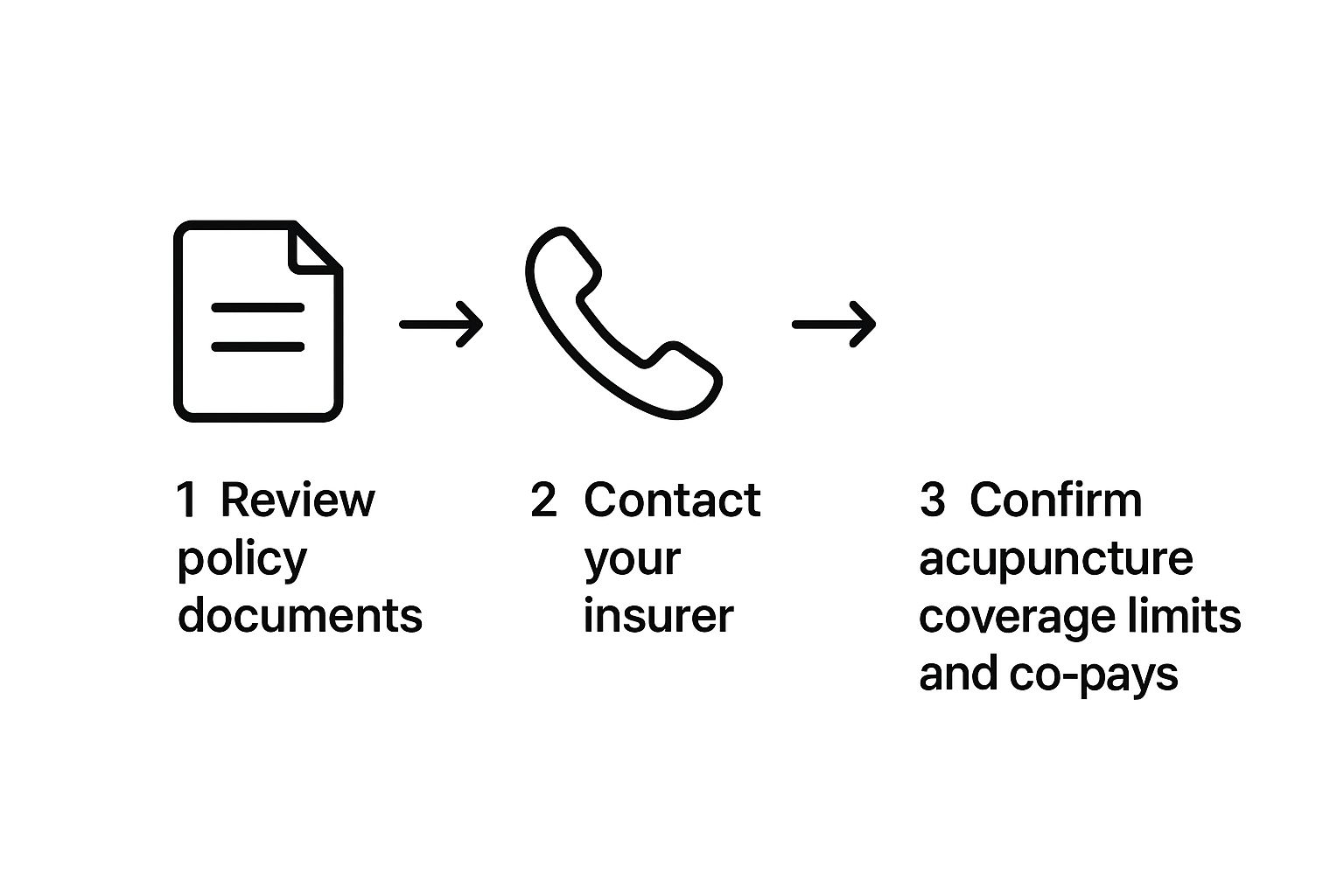

This visual guide breaks down the whole verification process into three simple, straightforward stages.

The takeaway here is that confirming your benefits is an investigation, not a single yes-or-no question.

Essential Questions for Your Insurance Provider

When you get a representative on the line, your job is to become a friendly detective. You're not just confirming coverage; you're uncovering all the rules, requirements, and costs that go along with it.

To make sure you don't miss anything important, it helps to have a checklist ready. The table below outlines the critical questions to ask to get a complete picture of your acupuncture benefits.

| Question Category | Specific Question to Ask |

|---|---|

| Requirements | "Do I need a referral from my doctor or pre-authorization before I can start treatment?" |

| Provider Network | "Must I see an acupuncturist who is in-network, or do I have out-of-network benefits?" |

| Your Costs | "What is my copay or coinsurance for each acupuncture visit? Have I met my annual deductible?" |

| Coverage Limits | "Are there any limits on how many visits are covered per year or a maximum dollar amount?" |

Having these answers helps you and your acupuncturist create a treatment plan that works for both your health and your wallet.

Alternatively, if you prefer to do your own digging, you can usually find this information by logging into your insurer's online portal. Look for your plan documents, often called the "Evidence of Coverage" or "Summary of Benefits." This document is the official contract and the final word on what your plan covers.

Expert Tip: Always ask for a reference number at the end of your call with the insurance representative. This little number is your proof of the conversation and can be a lifesaver if any disputes or claim issues pop up down the road.

By taking these steps, you'll trade uncertainty for confidence. You’ll have a clear understanding of what your insurance will pay for, what your out-of-pocket costs will be, and any hoops you need to jump through first.

Understanding the Codes That Get Your Claims Paid

To get your acupuncture claim approved, you have to speak the insurance company’s language—and that language is all about codes. Think of it as a specific recipe the insurer needs to see. If even one ingredient is wrong, the whole dish is rejected.

For a claim to go through successfully, two critical pieces of information must align perfectly. When they don't, even a plan that explicitly covers acupuncture will kick back a denial.

First, your acupuncturist will submit a CPT (Current Procedural Terminology) code. This tells the insurance company what service you received. For instance, code 97810 is used for the initial acupuncture session, and 97811 is added for each additional 15 minutes of treatment.

But the "what" is only half the story. The insurer also needs to know why you received that treatment.

The Power of Matching Codes

The "why" is communicated through a diagnosis code, known as an ICD-10 (International Classification of Diseases) code. This is arguably the most important part of the puzzle. If your policy only covers acupuncture for chronic low back pain, your claim must include a specific code like M54.5 to reflect that diagnosis.

This is the very definition of "medical necessity" in the eyes of an insurer. The CPT code shows what your acupuncturist did, and the ICD-10 code proves it was for a valid, covered medical reason.

A claim tells a story to the insurer. The CPT code is the action (the treatment), and the ICD-10 code is the reason (the diagnosis). If the reason doesn't justify the action based on your policy's rules, the story falls apart—and the claim gets denied.

This is also why your acupuncturist's detailed treatment notes are so crucial. Those notes are the evidence that backs up the codes, documenting your condition, your progress, and why the treatment remains medically necessary.

Most claim denials boil down to simple coding errors. A mismatched CPT and ICD-10 code, or a diagnosis that isn't on your plan’s approved list, gives an insurer an easy reason to say no. The best way to avoid this headache is to work closely with your provider to ensure every detail is correct from the very first visit.

What to Do When Your Acupuncture Claim Is Denied

Seeing a claim denial in the mail can be frustrating, but don't let it be the end of the road. Think of it less as a final "no" and more as an invitation to provide more information. The first thing you need to do is become a detective.

Your primary clue is the Explanation of Benefits (EOB) sent by your insurance company. This document is your roadmap, detailing exactly why they made their decision. Often, the culprit is a simple clerical error—a typo in a diagnosis code, for instance. Other times, the insurer might have flagged the treatment as not "medically necessary," a determination you can absolutely challenge.

Taking Action After a Denial

Once you understand the "why" behind the denial, it's time to team up with your most valuable ally: your acupuncturist's office. They've navigated these waters before and are essential for building a strong appeal.

This isn't a battle you have to fight alone. Together, you'll take a few critical steps:

-

Correct the Paperwork: Your acupuncturist's billing staff can double-check the claim to ensure every CPT and ICD-10 code perfectly matches your diagnosis and the treatment you received. A small coding mistake is a common and easily fixable reason for denial.

-

Launch an Internal Appeal: This is your formal request for the insurer to take a second look. You’ll typically fill out an appeals form and attach a powerful letter from your acupuncturist. This letter should clearly explain why the treatments are medically necessary, backed by clinical notes and documentation about your progress.

If the insurance company still holds its ground after the internal appeal, you’re not out of options. You have the right to request an external review. This brings in an independent, third-party reviewer to look at your case with a fresh set of eyes. Many denials are successfully overturned at this stage.

The secret weapon here is persistence. Know your rights, work closely with your provider, and don't give up.

Your Top Acupuncture Insurance Questions, Answered

Let's be honest: figuring out what your insurance will and won't cover for acupuncture can feel like a puzzle. To help you piece it all together, here are straightforward answers to the questions we hear most often from patients.

Does Insurance Cover Acupuncture for Fertility or Anxiety?

This is a big one. While we're seeing more plans cover acupuncture for pain, coverage for conditions like fertility or anxiety is unfortunately still quite rare.

Most insurers don't classify these treatments as “medically necessary,” which is the key phrase they look for. So, even if your plan includes acupuncture benefits, they are almost always tied to specific diagnoses, like chronic back pain, and will exclude other conditions. It's always best to verify your benefits for your specific health concern before starting treatment.

Do I Need a Referral From My Doctor?

That all comes down to the type of insurance plan you have.

- HMO Plans: With an HMO, you'll almost certainly need a referral from your primary care physician (PCP) before your insurance will cover visits to a specialist, and that includes an acupuncturist.

- PPO Plans: PPOs are typically more flexible. In most cases, you can see a specialist without getting a referral first.

Even if you have a PPO and don't technically need a referral, getting one can be a smart move. A formal diagnosis and a recommendation from your doctor can be a powerful tool to help prove medical necessity to your insurer, which can make a real difference in getting your claim approved.

Can I Use My HSA or FSA for Acupuncture?

Yes, absolutely! The IRS officially recognizes acupuncture as a qualified medical expense. This is great news because it means you can confidently use the pre-tax funds in your Health Savings Account (HSA) or Flexible Spending Account (FSA) to pay for your treatments. This applies even if your primary health insurance plan doesn't cover acupuncture directly.

At Eric Tsai Acupuncture and Herbs, we know firsthand that dealing with insurance can be a headache. We're proud to accept major insurance plans and offer complimentary benefit verification to give you the clarity you need. Find out if your plan covers your treatment today.