Let's cut right to the chase: Yes, many health insurance plans do cover acupuncture, but it's far from a sure thing. The trend toward covering acupuncture is definitely growing, but whether your specific plan will pay for it depends heavily on the policy itself, where you live, and the medical reason you're seeking treatment.

Decoding Your Acupuncture Insurance Benefits

Trying to figure out if your insurance covers acupuncture can feel like trying to solve a complex puzzle. Every piece—from your specific medical diagnosis and plan type (like an HMO or PPO) to state-level insurance laws—has to fit together just right.

This section will help you put those pieces together. We'll go beyond a simple "maybe" and give you the tools you need to confidently investigate what your own policy actually offers.

The Current State of Coverage

Even with growing acceptance, getting acupuncture covered is still a mixed bag. The insurance landscape is anything but uniform; what one person's plan covers, a colleague's plan from the same carrier might not. This is precisely why you have to do your own homework and verify your benefits before your first appointment.

In fact, a 2024 review of 45 different commercial and government health plans found that only about 33% of them covered acupuncture services. It’s clear that while progress has been made, coverage is by no means guaranteed. You can get a better sense of the bigger picture by exploring insurance coverage trends for complementary medicine.

Key Factors That Determine Your Acupuncture Coverage

Insurance companies don't make these decisions on a whim. They rely on a specific set of criteria to evaluate whether your acupuncture treatments are eligible for coverage. Understanding these factors is the first and most important step to getting your claims approved.

Here’s a quick look at the main elements insurance companies consider when deciding whether to approve acupuncture treatments.

Key Factors That Determine Your Acupuncture Coverage

| Factor | How It Impacts Your Coverage |

|---|---|

| Medical Necessity | Insurers almost always require a documented medical reason. Coverage is usually reserved for specific, pre-approved conditions like chronic low back pain, migraines, or chemotherapy-induced nausea. |

| Plan Type & Structure | Your policy type plays a massive role. An HMO might require a referral from your primary care doctor, while a PPO could offer more freedom to choose any licensed acupuncturist. |

| State Mandates | Some states have laws requiring insurers to cover certain alternative treatments, including acupuncture. Your zip code can directly influence your access to benefits. |

| Practitioner Credentials | To qualify for reimbursement, most insurance plans insist that treatment be performed by a Licensed Acupuncturist (L.Ac.). |

At the end of the day, these factors work together to paint a complete picture for the insurer.

The biggest takeaway here is that the logo on your insurance card doesn't tell the whole story. Two people with plans from the exact same carrier can have wildly different benefits. That's why digging into your specific policy details is absolutely essential.

How Major Insurance Providers Cover Acupuncture

When you see a big name like Blue Cross Blue Shield, Aetna, Cigna, or UnitedHealthcare on an insurance card, it’s easy to think all their plans are more or less the same. But when it comes to acupuncture covered by insurance, that assumption can be a costly mistake. The logo on your card is just the first page of a much more detailed story.

Think of it like this: Ford sells a huge range of vehicles. A basic Ford Fiesta is a world apart from a fully-loaded F-150 truck—different features, different performance, different price tag. They're both Fords, but that’s where the similarity ends. It’s the same with insurance. One person's Cigna PPO plan might generously cover 20 annual acupuncture sessions for chronic headaches, while another's Cigna HMO might demand a doctor's referral and only approve 10 sessions for the exact same issue.

Common Coverage Patterns You Will Encounter

While no two plans are identical, I've seen some definite trends emerge across the major insurance carriers over the years. Most of them operate from a list of pre-approved conditions they deem "medically necessary" for acupuncture. This list nearly always includes chronic pain and specific types of nausea.

So, what conditions get the green light most often?

- Chronic Low Back Pain: This is, by far, the most universally covered condition. The moment Medicare began covering it, most private insurers quickly followed suit.

- Neck Pain: Another very common complaint that carriers are comfortable approving for treatment.

- Migraines and Tension Headaches: Many policies explicitly name various types of headaches as qualifying conditions.

- Nausea and Vomiting: This is especially true when it’s a side effect of chemotherapy or post-operative recovery.

- Osteoarthritis: You'll often see coverage approved for osteoarthritis, particularly for knee pain.

On the flip side, treatments for general wellness, stress relief (without a formal diagnosis), or help with smoking cessation are usually considered non-essential and rarely get covered.

The key isn't whether a carrier like UnitedHealthcare covers acupuncture in general—they absolutely do, for some plans. The real question is whether your specific plan covers it for your specific condition. That’s the detail that makes all the difference.

Why Your Specific Plan Is All That Matters

You have to remember that insurance companies create a vast menu of plans for different employers and individuals. A large tech firm might negotiate a premium plan with robust benefits, including comprehensive acupuncture coverage. At the same time, a small business might choose a bare-bones plan from the very same insurer that offers no acupuncture benefits whatsoever.

For instance, a Blue Shield Gold PPO plan from a major corporation could have very few restrictions. In contrast, a Blue Shield Bronze HMO bought on the individual market might have a tiny network of approved providers and require strict pre-authorization for every single visit. This is exactly why going by the insurer's name alone is a recipe for surprise medical bills.

Taking the time to investigate the specifics of your policy isn't just a good idea; it's a critical step. You can learn more about how health insurance covers acupuncture and why these details are so important.

This variability means you have to become the expert on your own policy. Directly verifying your benefits is the only way to know for sure what you'll be expected to pay. A little proactive effort upfront saves you from financial headaches later and puts you in control of your healthcare decisions.

Understanding Medicare and Medicaid Acupuncture Rules

When we talk about government health plans like Medicare and Medicaid, the rules for acupuncture are a whole different ballgame compared to private insurance. These programs have very specific, non-negotiable guidelines. If you're a senior or enrolled in a state-sponsored plan, getting a handle on these rules is absolutely essential.

The biggest shift in this space happened a few years back when Medicare made a landmark decision to start covering acupuncture. This was a huge deal, not just for patients, but for the entire field. When Medicare decides to cover something, private insurers often sit up and take notice.

But here’s the catch: Medicare’s coverage is incredibly narrow. It’s not for just any ache or pain. The program approved it for one single, widespread condition: chronic low back pain. This was a major nod from the establishment, acknowledging acupuncture's power for this very specific issue.

Medicare's Strict Guidelines For Back Pain

To have acupuncture covered by insurance under a Medicare plan, your condition has to fit their precise definition. It's not enough to just say you have back pain; it needs to be officially chronic.

So, what does that mean? According to Medicare, your low back pain must:

- Have lasted for 12 weeks or longer.

- Not be caused by a known systemic issue (like an infection, inflammatory disease, or cancer).

- Not be related to a recent surgery or pregnancy.

If your situation ticks all those boxes, Medicare Part B will cover up to 12 acupuncture sessions over a 90-day period. And if you’re seeing real improvement after that, they may authorize an additional 8 sessions. You can find all the official details by reading Medicare's official acupuncture coverage rules.

This highly structured approach shows how government programs are carefully weaving acupuncture into their benefits, but only where strong evidence supports its use—primarily for managing pain when other options haven't worked.

How Medicaid Handles Acupuncture Coverage

Now, Medicaid is a completely different animal. While Medicare is a federal program with the same rules for everyone across the country, Medicaid isn't so simple. It’s a joint federal and state program, which means every state sets its own coverage policies.

The result is a true patchwork of benefits. You might find that one state provides excellent acupuncture coverage for a range of conditions, while its next-door neighbor offers nothing at all.

Your Medicaid coverage for acupuncture depends entirely on the state you live in. There is no single, nationwide policy. You have to check directly with your state's Medicaid agency to know for sure.

This state-by-state approach means the legwork is on you. The only way to get a definitive answer is to visit your state’s Medicaid website or call their member services line to ask if your acupuncture treatments will be covered.

Your Step-By-Step Guide To Verify Your Benefits

Hoping your plan offers acupuncture covered by insurance is a risky bet. The only sure way to sidestep surprise bills and know your real out-of-pocket cost is to verify your benefits directly with the insurance company before your first appointment. Taking this step puts you in the driver's seat.

Think of it like this: you'd never let a contractor tear down a wall without getting a written estimate first. Verifying your insurance benefits is the exact same idea, just applied to your health. It’s all about getting clarity on the costs involved upfront.

How To Start The Verification Process

Your insurance card is the key. Flip it over and find the phone number for "Member Services" or sometimes "Provider Services." That's your direct line to a representative who can pull up the specific details of your plan.

Before you make the call, do a little prep work. The conversation will go much smoother if you have your insurance card in hand (they'll need your member ID) and a list of questions ready. Don't be timid—your goal is to hang up the phone with zero doubt about what's covered and what isn't.

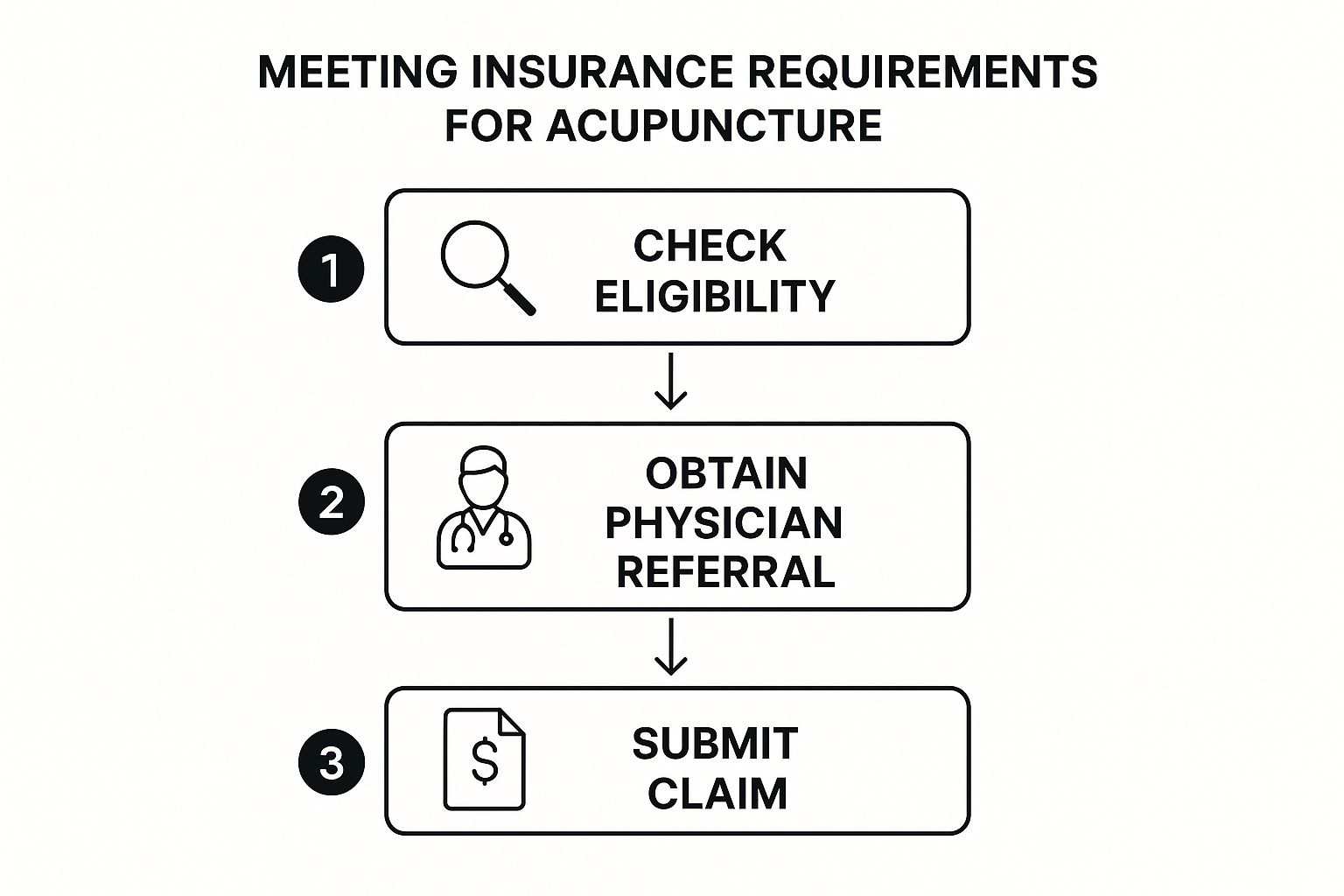

Navigating insurance usually involves a few key steps, from checking your eligibility all the way through to submitting a claim.

As you can see, verifying your benefits is the critical first move. It sets the stage for everything else, like getting a required referral or filing for reimbursement later on.

The Essential Questions To Ask Your Insurer

When you get a representative on the line, you need to be direct. Vague questions will only get you vague answers. Use the following questions as a guide to get the details that really matter for acupuncture coverage.

Start the conversation with a clear statement: "I would like to verify my benefits for acupuncture treatment."

Then, work your way through these critical questions:

-

"Does my specific plan cover acupuncture services?"

- This is the essential yes/no question. If they say no, you've just saved yourself a ton of time and potential confusion.

-

"Which medical conditions are covered for acupuncture?"

- This is huge. Many plans only cover acupuncture for a shortlist of diagnoses, like chronic low back pain, but won't cover it for something like fertility or anxiety. Have them list the approved conditions.

-

"Do I need a referral from my primary care doctor or a pre-authorization before I start treatment?"

- Missing this step is one of the most common reasons claims get denied. You have to know the rules of the road.

-

"Is there a limit on the number of visits per year?"

- It's very common for plans to cap coverage at a set number of sessions, often 12 or 20 per year.

-

"What are my out-of-pocket costs? I need to know my deductible, copay, and any coinsurance for each visit."

- This is the bottom line—it tells you exactly what you should expect to pay each time you go in for an appointment.

-

"Do I have to see an in-network acupuncturist, or do I have benefits for out-of-network providers?"

- The answer to this will determine your options and dictate which practitioners you can see.

Pro Tip: Before you hang up, always ask for a reference number for the call. This gives you a record of the conversation and the information you were provided, which can be incredibly helpful if any disputes come up later.

By running through this checklist, you go from being a patient who's just hoping for coverage to an informed consumer who knows exactly what their financial responsibility is before the first needle is ever placed.

Why More Insurance Plans Are Covering Acupuncture

The growing trend of acupuncture covered by insurance isn't just a happy accident. It’s a deliberate shift driven by two powerful forces: a mountain of compelling scientific evidence and undeniable patient demand. For a long time, most insurers classified acupuncture as an unproven, "alternative" treatment, but that viewpoint is finally and steadily changing.

This isn't based on guesswork. The change is built on a solid foundation of clinical research. An ever-growing collection of studies has proven acupuncture's effectiveness, especially for managing pain. This gives insurance companies the one thing they need to make a change: data. With hard evidence, they can confidently move acupuncture from the "alternative" bucket to the "medically necessary" one for certain conditions.

The core reason for this shift is simple: clinical evidence and cost-effectiveness. When research shows that acupuncture can manage pain effectively—potentially reducing the need for more expensive procedures or long-term medications—insurers have a financial incentive to cover it.

The Rise of Non-Drug Pain Solutions

At the same time, we're seeing a huge cultural shift. Patients are actively looking for pain relief that doesn't come from a pill bottle. Widespread concerns about the side effects, dependency risks, and long-term impact of prescription pain medications have pushed millions to seek out safer, more sustainable solutions.

Acupuncture fits this need perfectly. This massive wave of patient-driven demand creates a market force that insurers simply can't ignore. As more people ask for acupuncture and experience its benefits firsthand, the pressure on insurance companies to add it to their plans grows stronger. You can see these principles in action by exploring how we use acupuncture for chronic pain in our clinic.

A Growing Global Market Reflects Acceptance

This isn't just happening here; it's a global phenomenon. The worldwide acupuncture market, valued at an estimated USD 48.10 billion in 2025, is on track to hit an incredible USD 78.21 billion by 2032. This explosive growth is a direct result of wider insurance recognition and a greater public embrace of integrative medicine.

North America is leading the charge, making up about 32.3% of the entire market share. These numbers tell a clear story of growing acceptance. If you're interested in the financial side, you can dig deeper into the global acupuncture market analysis.

Ultimately, seeing acupuncture covered by more insurance plans is a major step forward. It signals that this ancient practice has finally earned its rightful place as a valuable, evidence-backed tool in modern healthcare—a win for patients seeking relief and the companies that insure them.

Common Questions About Insurance For Acupuncture

https://www.youtube.com/embed/xxATI4SDZFo

Once you get the basics of your coverage, the real-world questions start popping up. It's one thing to know your policy should cover acupuncture, but it's another thing entirely to navigate the practical steps. Let’s walk through some of the most common questions and sticking points we see from patients every day.

My goal here is to give you the confidence to handle these situations, whether you're staring down a claim denial, figuring out how to use your health savings account, or trying to get a doctor's referral. We want to make sure your acupuncture covered by insurance is a smooth reality.

What Should I Do If My Insurance Denies An Acupuncture Claim?

Getting a claim denial in the mail is frustrating, but don't panic. It’s often not the final word on the matter. The key is to stay calm and approach it like a detective solving a case. You have the right to appeal, and a systematic approach is your best bet.

First, pull out the "Explanation of Benefits" (EOB) that came with the denial. This document is your first clue—it will have a specific reason code explaining why the claim was rejected. It could be anything from a missing pre-authorization or a simple coding error to the insurer deciding the treatment was "not medically necessary."

Once you know the reason, here’s your game plan:

- Call Your Insurance Company: Start with a call to a representative to clarify the denial. Sometimes, it’s just a small clerical mistake that a quick phone call can clear up.

- Contact Your Acupuncturist's Office: Loop them in immediately. Their billing team deals with this all the time and can often resubmit the claim with corrected information or provide the extra documentation the insurer needs.

- Initiate a Formal Appeal: If a simple fix doesn't work, it's time to file a formal appeal. This is a written request asking the insurance company to take a second look. You’ll need to write a clear letter explaining why the treatment should be covered and include supporting documents from both your doctor and acupuncturist.

Think of a denial not as a "no," but as a "prove it." A well-organized appeal that clearly shows the medical need for your treatment has a very good chance of being overturned.

Do I Need A Doctor's Referral For Insurance To Cover Acupuncture?

This is a huge point of confusion, and the honest answer is: it depends entirely on your insurance plan. There’s no single rule that applies to everyone.

- HMO (Health Maintenance Organization) Plans: With an HMO, you almost always need a referral from your Primary Care Physician (PCP) to see any specialist, and that includes an acupuncturist. If you have an HMO, getting that referral is your non-negotiable first step.

- PPO (Preferred Provider Organization) Plans: PPOs are usually more flexible. They often don't require referrals, allowing you to book an appointment directly with an acupuncturist in your network.

Even if you have a PPO, it's smart to check your benefits first. Some PPO plans might still want a "letter of medical necessity" from a doctor to justify the treatment, especially for long-term or chronic conditions. Knowing your plan's specific rules ahead of time is the best way to prevent a claim denial later. To learn more about how acupuncture can help with specific issues, you can explore the benefits of acupuncture for pain management.

Can I Use My FSA Or HSA For Acupuncture Costs?

Yes, absolutely! This is one of the best tools at your disposal. The IRS officially recognizes acupuncture as a qualified medical expense. This means you can use the pre-tax money in your Flexible Spending Account (FSA) or Health Savings Account (HSA) to pay for your treatments.

These accounts are perfect for covering your out-of-pocket costs, such as:

- Copayments and coinsurance

- Payments toward your deductible

- The full cost of treatment if your insurance doesn't offer acupuncture benefits

Using your FSA or HSA is as easy as swiping a debit card at your acupuncturist's office. It’s a fantastic way to make care more affordable, no matter what your insurance policy says.

At Eric Tsai Acupuncture & Herbs, we know that figuring out insurance can be just as stressful as the health condition you’re trying to treat. We offer complimentary benefit verification to take the guesswork out of the equation for you. If you're ready to see how acupuncture can help, visit us online to schedule a consultation, and let us handle the insurance maze for you.