Does insurance cover alternative medicine? The honest answer is: it depends. It can feel like navigating a maze, but understanding the rules of the game makes all the difference. Think of it less as a simple 'yes' or 'no' and more of a specific set of conditions for treatments like acupuncture, chiropractic care, and massage therapy.

Why Alternative Medicine Coverage Varies So Much

When you get into insurance for alternative treatments, you quickly learn that no two plans are the same. Insurers weigh a few key factors before deciding what they'll pay for, including proven effectiveness, state regulations, and—most importantly—medical necessity. This creates a patchwork system where one person’s plan might cover weekly acupuncture sessions while a colleague’s plan covers none at all.

This variability is the central hurdle. Even as the global market for complementary and alternative medicine (CAM) has exploded, valued at approximately USD 179-197 billion, inconsistent insurance coverage remains a major roadblock for patients.

The Key Role of "Medical Necessity"

If there's one term you need to understand, it's “medical necessity.” Insurers are in the business of covering treatments for diagnosed health problems, not general wellness. They are far more likely to approve a therapy if your doctor or another licensed professional says it's essential for treating a specific condition.

- Likely Covered: A physician prescribes acupuncture to treat documented chronic lower back pain.

- Likely Not Covered: Getting a massage for general stress relief without a related medical diagnosis.

This distinction is everything. It's what separates a treatment for a specific ailment from a wellness activity, and most insurance plans draw a hard line between the two. Getting a handle on the core differences between https://drerictsai.com/f/%F0%9F%A7%8D%E2%80%8D%E2%99%82%EF%B8%8Feric-tsai-lac-msaom-bpharm#44cae461-999c-4ec1-82f4-fe3dbdc25492/holistic-medicine-vs-conventional-medicine can also shed light on why insurers view these services differently.

A Look at Different Therapies

Acceptance isn't uniform across all alternative therapies. Chiropractic care, for instance, is now widely covered for specific spinal issues. On the other hand, newer or less-researched treatments often face an uphill battle for approval. It’s common for people to wonder, for example, is hyperbaric oxygen therapy covered under insurance.

Your insurance policy is a contract, plain and simple. It spells out exactly which services the company is obligated to pay for, under what circumstances, and for how long. The decision is less about the therapy’s inherent value and more about whether it ticks the specific boxes laid out in your plan’s rulebook.

Ultimately, the fine print in your insurance documents is the final word. The single most important step you can take is to call your provider and verify your benefits before you start any treatment.

To give you a general idea, here’s a quick look at where some popular therapies typically stand with insurance carriers.

Quick Guide to Common Alternative Therapy Coverage

This table provides a snapshot of the typical insurance coverage status for several popular alternative medicine treatments. Keep in mind that your specific plan details will always be the deciding factor.

| Therapy Type | Typical Coverage Status | Common Conditions Covered |

|---|---|---|

| Acupuncture | Increasingly common, especially for pain management. | Chronic pain (back, neck, knee), migraines, nausea. |

| Chiropractic Care | Widely covered, but often with visit limits. | Neck/back pain, sciatica, headaches, joint problems. |

| Massage Therapy | Varies; more likely covered if prescribed by a doctor. | Post-injury rehabilitation, muscle spasms, chronic pain. |

| Naturopathic Care | Coverage is limited and highly dependent on state laws. | Varies widely; often for consultations, not supplements. |

| Herbal Medicine | Almost never covered directly by insurance plans. | Can sometimes be paid for with FSA or HSA funds. |

This guide should help set expectations, but it’s no substitute for confirming the specifics of your own policy. Always check with your provider to be certain.

Learning the Language of Insurance Claims

Before you can confidently get your insurance coverage for alternative medicine, you have to learn to speak the language. Think of your insurance policy as a rulebook for a game—if you don't know what the key terms mean, you can't really play to win.

Getting a handle on this lingo is what empowers you to ask the right questions and truly advocate for the care you need. It’s not about memorizing a dictionary; it’s about understanding a few core ideas that are the difference between a claim getting paid or getting denied. Master these, and your conversations with insurance reps will go from confusing and frustrating to clear and productive.

Understanding Core Insurance Terminology

The first and most important term, as we touched on earlier, is medical necessity. This is the official justification from your doctor or practitioner explaining why a treatment is essential for your health, not just something that would be nice to have for general wellness.

Next up is prior authorization. This is a big one. Think of it as getting permission from your insurance company before you start a treatment. Many plans require you to get the green light for something like a series of acupuncture sessions before they will agree to pay. Forgetting this step is one of the quickest ways to get stuck with the entire bill.

Finally, you’ll hear in-network and out-of-network all the time.

- In-Network Providers: These are the practitioners who have a contract with your insurance company. They've agreed to accept a certain discounted rate for their services, which means your out-of-pocket costs will be much lower.

- Out-of-Network Providers: These practitioners don't have a contract with your insurer. While you can still see them, you'll pay a lot more, and some plans won't cover their services at all.

Putting the Concepts into Practice

Knowing these terms individually is a good start, but the real trick is understanding how they interact. For example, your claim for acupuncture could be denied simply because the provider is out-of-network, even if your doctor proved it was medically necessary. Likewise, if you skip the prior authorization step, your claim will almost certainly be rejected, no matter who you see.

Think of these terms as a series of gates you have to pass through. To get the best coverage, a treatment needs to be medically necessary, have prior authorization (if required), and be done by an in-network provider. Each gate is a potential roadblock if you aren't prepared.

This framework is your key to navigating the entire system. Now, when you call your insurer, you can ask sharp, specific questions like, "Does my plan require prior authorization for acupuncture CPT codes?" or "Can you confirm that this specific acupuncturist is in-network for my policy?" This kind of clarity helps you get the real answers you need and avoid those dreaded surprise bills later on.

Which Alternative Therapies Get Covered Most Often?

When it comes to getting insurance to cover alternative medicine, you'll quickly find that not all therapies are created equal. Insurers tend to be cautious, and they're far more likely to pay for a treatment with a solid track record and a growing body of scientific evidence to back it up.

Think of it this way: from an insurer's perspective, a treatment needs to prove its worth. Over the years, certain therapies have built such a strong case for themselves that they’ve moved from the fringes of medicine into a more mainstream, accepted role. This means that while your plan might not cover every holistic practice under the sun, it probably has provisions for a select few.

The Big Three of Alternative Care Coverage

For most health plans, if they cover alternative therapies at all, they almost always start with acupuncture, chiropractic care, and sometimes, massage therapy. These are often the first—and occasionally the only—alternative treatments that insurers will even consider.

-

Chiropractic Care: This is the heavyweight champion of alternative care coverage. Insurers have been covering chiropractic adjustments for years, especially for well-documented musculoskeletal problems like chronic lower back pain, neck pain, sciatica, and certain headaches. Just be aware that coverage usually comes with strings attached, like visit limits or the need for a doctor's referral.

-

Acupuncture: Once seen as exotic, acupuncture is now a common benefit in many health plans. Coverage is almost always tied to specific diagnoses, with chronic pain management leading the pack. In fact, acupuncture is gaining serious traction in the U.S., with a growing number of insurers covering its costs and giving more patients access. You can see just how much the industry is expanding in this alternative healthcare providers market report on ibisworld.com.

-

Massage Therapy: This one is a bit more of a wild card. Getting a massage covered for general stress relief is highly unlikely. However, insurers are often willing to pay when it’s prescribed by a doctor as a specific part of a larger treatment plan, like for injury rehabilitation or to manage chronic muscle spasms.

Why “Medical Necessity” Is Still King

Even with these more accepted therapies, getting a claim approved isn't automatic. The entire decision hinges on a single, powerful concept: medical necessity. An insurer will only open its wallet if the treatment is deemed essential for a diagnosed health condition.

An insurance plan won't pay for a therapy just because it feels good or is beneficial in a general sense; it will pay when it's necessary to treat a specific medical problem. This distinction is the bedrock of every coverage decision.

This is why a prescription or a detailed note from your doctor is your most powerful tool. It creates a direct link between the therapy and your diagnosis.

For example, a plan might cover acupuncture to treat nausea caused by chemotherapy but deny it for general wellness. In the same way, chiropractic care might be approved for a diagnosed spinal issue but not for routine "maintenance" adjustments. You can learn more about which conditions are often approved by exploring our guide on alternative therapies for chronic pain.

At the end of the day, your best bet is to focus on these commonly covered therapies and ensure they are prescribed for a medically necessary reason. That combination gives you the highest odds of getting reimbursed. Always start by calling your insurer to verify your specific benefits—it’s the only way to know for sure what your plan will and won’t cover.

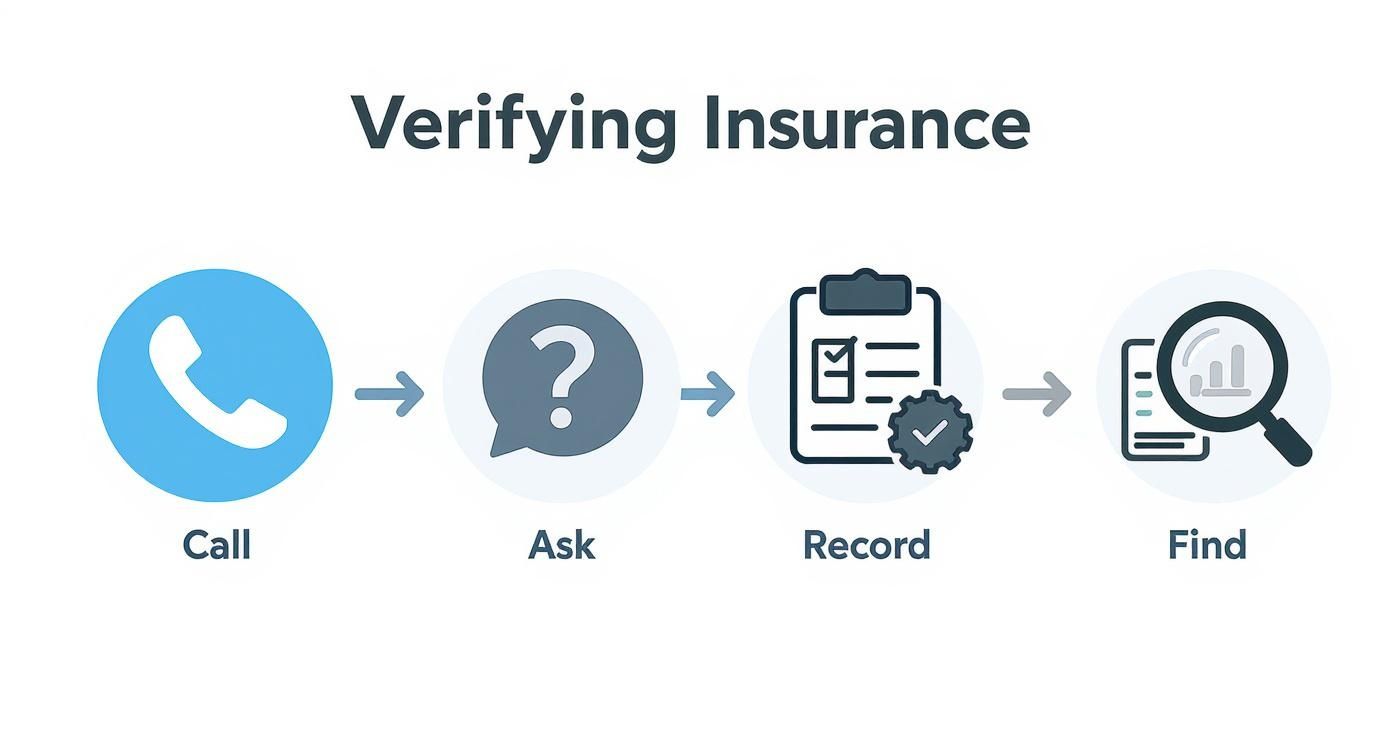

How to Verify Your Benefits in Four Simple Steps

Knowing the lingo of the insurance world is a great start, but the real test is putting that knowledge to work. To get straight answers about your insurance coverage for alternative medicine, you need to be direct. Don't think of it as a confrontation; see it as a fact-finding mission to confirm exactly what your plan covers before you start treatment.

With just a little prep work, you can handle the conversation with confidence and get the information you need. The trick is to be organized, specific, and ready to take good notes.

This visual guide boils the whole process down into four clear, manageable actions. No more guesswork.

Following this process ensures you get all the details methodically. It’s your best defense against surprise bills and denied claims later on.

Step 1: Locate the Right Contact Information

First things first, you need the right phone number. Flip over your insurance card and look for a toll-free number labeled "Member Services" or "Benefits and Eligibility." That’s your direct line to a representative who can pull up your specific plan details.

Try to avoid calling the general customer service line. You want to speak with someone who deals with benefit verification all day long.

Step 2: Ask Targeted Questions

Once you have a representative on the phone, your goal is to be incredibly precise. A vague question like, "Do you cover acupuncture?" will likely get you a vague, unhelpful answer. You need to use the right terminology to get the facts.

Here’s a simple script to get you started:

"Hello, I'd like to verify my benefits for acupuncture. The CPT codes my provider will be using are 97810, 97811, 97813, and 97814. Can you please tell me:

- Do I have coverage for these specific CPT codes?

- Is prior authorization required for these services?

- What is my deductible for these services, and how much of it have I met?

- What is my copay or coinsurance amount for each visit?

- Is there an annual limit on the number of visits?"

This level of detail prompts a specific response and signals to the representative that you've done your homework. For a deeper dive into what to ask, you can find more helpful acupuncture insurance coverage questions to make sure you’re fully prepared.

Step 3: Record Everything

Documentation is your safety net. This is a big one. Before you hang up, always ask for a call reference number. This little number is your proof that the conversation happened and can be a lifesaver if a claim is later denied.

You should also jot down:

- The date and time of your call.

- The name of the representative you spoke with.

- The specific answers they gave you for each question.

Step 4: Find In-Network Providers

Finally, head to your insurer's website and use their online provider directory to find practitioners who are in-network. This is a critical step. Going in-network means you’ll get the highest level of coverage and pay the lowest out-of-pocket costs.

Never just assume a provider is in your network, even if they say they are. Always double-check it yourself through the official portal or by asking the representative during your call. By following these four steps, you'll gain a clear picture of your benefits and take control of your healthcare choices.

What to Do When Your Claim Is Denied

Getting a denial letter from your insurance company can feel like hitting a brick wall. It's frustrating, but it's important to know that this isn't necessarily the end of the road. A denied claim, especially for acupuncture or herbal medicine, is often just the opening move in a negotiation. Think of it less as a final "no" and more as a signal to adjust your approach.

Your first move is to become a detective. You need to understand exactly why they denied the claim. The insurer is required to give you a reason in writing, usually in a document called an Explanation of Benefits (EOB). Was it a simple clerical mistake, like a wrong billing code? Did you forget to get pre-approval? Or did they decide the treatment wasn't "medically necessary"? The reason they give you is the key to unlocking your next steps.

Building Your Case for an Appeal

Once you've identified the "why," you can kick off the formal appeals process. This is your official chance to ask the insurance company to take a second look and reconsider their decision. A strong appeal is all about clear evidence and a logical argument, so don't be intimidated. This is a standard part of the system, and you have every right to use it.

The most powerful tool in your arsenal is a Letter of Medical Necessity from your practitioner. This is far more than a simple doctor's note. It's a detailed, professional report that lays out your diagnosis, explains which mainstream treatments you've already tried without success, and makes a compelling case for why this particular therapy is critical for your health.

This letter is what shifts the perception of your treatment from a "nice-to-have" therapy to a medically essential intervention. It gives the insurance reviewer the clinical evidence they need to connect your treatment directly to your diagnosed condition and overturn the denial.

Now, start gathering all your paperwork. You'll want your complete medical records, the original denial letter, and a log of every conversation you've had with the insurance company. If your claim for alternative medicine coverage is denied, getting a handle on the appeals process is vital. This guide on what to do when your long-term disability claim is denied offers some great general strategies for navigating these bureaucratic hurdles, even though it's focused on a different type of claim.

Smart Financial Strategies for Out-of-Pocket Costs

While the appeal is in motion—a process that can take some time—you're not out of options for managing the cost of your care. Be sure to look into tax-advantaged accounts like a Health Savings Account (HSA) or a Flexible Spending Account (FSA). These accounts are a fantastic way to pay for qualified medical expenses using money you haven't paid taxes on yet.

Many alternative treatments are eligible expenses. This often includes:

- Acupuncture when used to treat a specific medical diagnosis.

- Chiropractic care for issues related to the nerves, muscles, and skeleton.

- Therapeutic massage if it's prescribed by a doctor to help you recover from an injury.

Using an HSA or FSA can dramatically lower your actual out-of-pocket costs, making treatment much more manageable while you wait for the insurance situation to resolve. Just be sure to double-check the current IRS rules on what qualifies and keep every single receipt. By pairing a well-supported appeal with smart financial planning, you can take back control and stay on your path to wellness.

Your Questions on Alternative Medicine Coverage Answered

Once you've got a handle on the basics of your policy, you'll inevitably run into specific, real-world questions. We've walked through how to check your benefits and what to do if you get a denial, but let's tackle some of the most common scenarios that pop up.

Think of this as the practical guide for what happens next—clearing up the gray areas around special health accounts and the logic behind your insurer's rules.

Can I Use My HSA or FSA for Treatments My Insurance Denied?

Yes, you absolutely can. This is one of the best ways to manage costs for care that falls outside your insurance plan's direct coverage. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are designed for exactly this purpose: letting you use pre-tax money for qualified medical expenses.

When your insurance says no, these accounts can often say yes. Many alternative therapies are eligible, including:

- Acupuncture for a diagnosed medical condition.

- Chiropractic care to address musculoskeletal problems.

- Massage therapy, as long as it's prescribed by a doctor for a specific issue like rehabilitation.

The key is to always check the latest IRS guidelines to confirm what’s considered a "qualified" expense. And hold onto your receipts! Using an HSA or FSA effectively softens the financial blow, making essential treatments much more accessible.

Why Does My Plan Cover Acupuncture for Back Pain but Not for General Wellness?

This is a very common point of confusion, and it all comes back to one crucial term: medical necessity. At its core, health insurance is built to cover the diagnosis and treatment of specific, documented medical problems. It's not really set up to cover general health maintenance or preventative wellness.

So, when your doctor documents that acupuncture is needed to treat your chronic migraines, that checks the "medical necessity" box for the insurer. But using that same treatment just to manage daily stress or stay healthy, while incredibly valuable, doesn't fit into their framework. This is why you'll almost always find that coverage is tied to a specific diagnosis.

Think of your insurance plan like a mechanic's warranty for your car. The warranty covers repairs when something breaks (a diagnosed condition), but it won't pay for your routine oil changes or tire rotations (wellness care). That's the logic insurers use for nearly every coverage decision.

How Much Does a Letter of Medical Necessity Really Help?

A Letter of Medical Necessity can be the single most influential tool in your corner, especially when you're trying to get a treatment approved or are fighting a denial. It’s a formal, clinical explanation from your doctor to the insurance company that details why a specific therapy is essential for your health.

This isn't just a simple recommendation. A strong letter provides a compelling, evidence-based justification, linking the alternative treatment directly to your diagnosis. It will often outline the conventional treatments you've already tried that didn't work, framing the requested therapy as the next logical and necessary step in your care. For many insurance reviewers, this letter is the deciding factor.

Is There Any Chance My Insurance Will Cover Herbal Supplements?

It's highly unlikely. Standard health insurance plans almost never cover the cost of herbal remedies or supplements. The main reason is that herbs aren't regulated by the FDA as prescription drugs; insurers categorize them as dietary supplements, not as recognized medical treatments.

Even if your licensed acupuncturist or naturopath prescribes them as a critical part of your treatment plan, the cost will almost certainly be an out-of-pocket expense. The good news is that you can often use your HSA or FSA funds for them, but you shouldn't expect a direct reimbursement from your health insurance company.

At Eric Tsai Acupuncture and Herbs, we know that figuring out insurance can feel as challenging as dealing with your health issues. We are in-network with most major providers and offer a complimentary benefits check to make sure you know exactly what your coverage looks like before you even start. Let us take the guesswork out of it for you. Book a consultation and see how we can help you find relief. Learn more and schedule your appointment today.