Yes, Cigna often covers acupuncture, but it's not a simple blanket approval. Your coverage really boils down to the specifics of your plan and why you're seeking treatment.

Unpacking Your Cigna Acupuncture Benefits

Figuring out your insurance benefits can feel like a maze. When you ask, "Does Cigna cover acupuncture?" the real answer is, "It depends." Many Cigna plans do include acupuncture, especially for pain management, which is a huge step forward in recognizing its value.

But—and this is a big but—the coverage isn't automatic. Cigna needs a good reason to pay for it, just like they would for any other medical procedure. Your eligibility is tied directly to having a specific, qualifying medical condition that Cigna agrees can be treated effectively with acupuncture.

Here’s a quick rundown of what Cigna looks at before giving the green light for your treatment.

Key Factors Determining Your Cigna Acupuncture Coverage

| Coverage Factor | What It Means for You |

|---|---|

| Your Specific Plan | An HMO plan will have different rules about referrals and network providers compared to a PPO plan. You have to play by your plan's rules. |

| Medical Necessity | Your diagnosis must be on Cigna's list of approved conditions for acupuncture, like chronic low back pain. A general "wellness" visit won't cut it. |

| Provider Network Status | Seeing an acupuncturist who is in-network with Cigna is the single best way to keep your out-of-pocket costs down. |

Think of these three factors as the pillars of your coverage. If one is missing—say, your condition isn't deemed a "medical necessity"—your claim could easily be denied. Getting a handle on these key pieces is the first step to making sure your treatments get covered.

Understanding Cigna's Medical Necessity Rules

When you're asking, "Does Cigna cover acupuncture?" the answer almost always comes down to one crucial concept: medical necessity. Think of it as Cigna’s litmus test. For a treatment to be covered, it has to be a proven, effective solution for a specific medical problem, backed by solid clinical evidence.

This means Cigna won't cover acupuncture for general wellness or simple stress relief, as beneficial as it might be. Instead, coverage is tied directly to your diagnosis. They are constantly looking at the latest scientific research to decide which conditions have enough evidence to warrant paying for acupuncture as a legitimate medical treatment.

Conditions That Meet Cigna's Criteria

Because of this evidence-first approach, only a handful of specific diagnoses will typically get the green light for acupuncture coverage under Cigna plans. Your acupuncturist must clearly link your treatment to one of these approved conditions on the claim form for it to even be considered.

While you should always check your specific plan, a few conditions consistently meet Cigna's standard for medical necessity:

- Chronic Low Back Pain: This is probably the most commonly approved condition for acupuncture.

- Osteoarthritis of the Knee: There's a lot of research showing acupuncture helps manage this specific type of joint pain.

- Chronic Neck Pain: Much like back pain, this is another diagnosis Cigna often recognizes for treatment.

Your diagnosis is the key that unlocks your benefits. Without a qualifying diagnosis code on your claim, Cigna’s system will likely issue an automatic denial, no questions asked.

It's also worth noting that Cigna gets very specific. Their policies typically cover traditional, needle-based acupuncture for these conditions. Other related treatments, like acupuncture point injections, are often considered experimental and won't be covered. To see the fine print for yourself, you can always dig into Cigna's medical coverage policies to find their official guidelines.

How Different Cigna Plans Impact Your Coverage

It’s great that Cigna covers acupuncture, but the real question is how your specific plan handles it. Think of your Cigna plan as the unique blueprint for your healthcare. Whether you have an HMO, PPO, or EPO, each one has a different set of rules for seeing specialists like an acupuncturist.

An HMO (Health Maintenance Organization) is structured a lot like a walled garden. Your Primary Care Physician (PCP) is the gatekeeper, and you’ll almost always need a referral from them to see anyone else. To get coverage, you must stay inside the garden—the plan’s network.

A PPO (Preferred Provider Organization), in contrast, gives you more freedom to roam. You have a list of "preferred" in-network providers, but you have the flexibility to see out-of-network practitioners, too. You won't need a referral, but stepping outside the network means you'll shoulder a bigger portion of the cost.

Navigating Your Plan's Specific Rules

The type of plan you have is the single biggest factor determining your out-of-pocket costs and the hoops you might have to jump through before your first appointment. You have to play by your plan's specific rules to make sure your claims get paid.

Here’s a breakdown of what to expect from each:

- HMO Plans: These are the most restrictive. You must see an acupuncturist in Cigna’s network. A referral from your PCP is almost always required, and Cigna may also demand pre-authorization before they agree to cover your sessions.

- PPO Plans: These offer the most flexibility. You can choose any licensed acupuncturist, but your costs will be significantly lower if you stick with an in-network provider. Referrals typically aren't needed, but don't be surprised if pre-authorization is still required for your treatment.

- EPO Plans (Exclusive Provider Organization): This is a bit of a hybrid. Like an HMO, you are required to stay within the network to get coverage (barring a true emergency). But, like a PPO, you usually don't need a referral from your PCP to see a specialist.

The most critical piece of advice I can give is this: Never assume your plan’s rules. Before you book anything, call the member services number on your Cigna ID card and confirm the referral and pre-authorization requirements yourself. For a wider view on this topic, check out our general guide on whether health insurance covers acupuncture.

Comparing Cigna Global and US Acupuncture Policies

If you're an expatriate or a frequent traveler, figuring out how your health insurance works across borders is a common headache. When it comes to acupuncture, the answer to "Does Cigna cover it?" changes drastically depending on whether you have a domestic US plan or a Cigna Global policy. The differences aren't just in the fine print; they reflect two completely different approaches to healthcare.

Here in the United States, Cigna's coverage is often tied to a strict definition of "medical necessity." This means acupuncture is typically only covered for a very specific list of conditions where it’s been clinically proven effective, like chronic low back pain.

A Broader Approach to Wellness Abroad

International healthcare systems, on the other hand, often have a much more integrated view of complementary therapies. Cigna Global plans are built for this reality.

Because these plans serve a diverse international market where demand for treatments like acupuncture is high, the policies are usually far more accommodating. Instead of restricting coverage to a few pain-related diagnoses, acupuncture is often treated as a standard outpatient benefit, available for general wellness.

This flexibility is a core feature of their international structure. For instance, Cigna Global Health Insurance frequently bundles acupuncture and Chinese medicine into its tiered plans for people living or working in over 200 countries. You can see exactly how these international plans are structured on InternationalInsurance.com.

This really gets to the heart of the difference for policyholders:

A US Cigna plan tends to see acupuncture as a targeted fix for a specific problem. A Cigna Global plan is much more likely to view it as a tool for maintaining overall health and well-being.

At the end of the day, your coverage is dictated entirely by where you are and which plan you have. A policy designed for someone living in Ohio will operate under a completely different set of rules than a Cigna Global plan for an expat in Singapore. It's crucial to check the specific details of your own policy, as even international plans can vary quite a bit based on the country and your chosen coverage level.

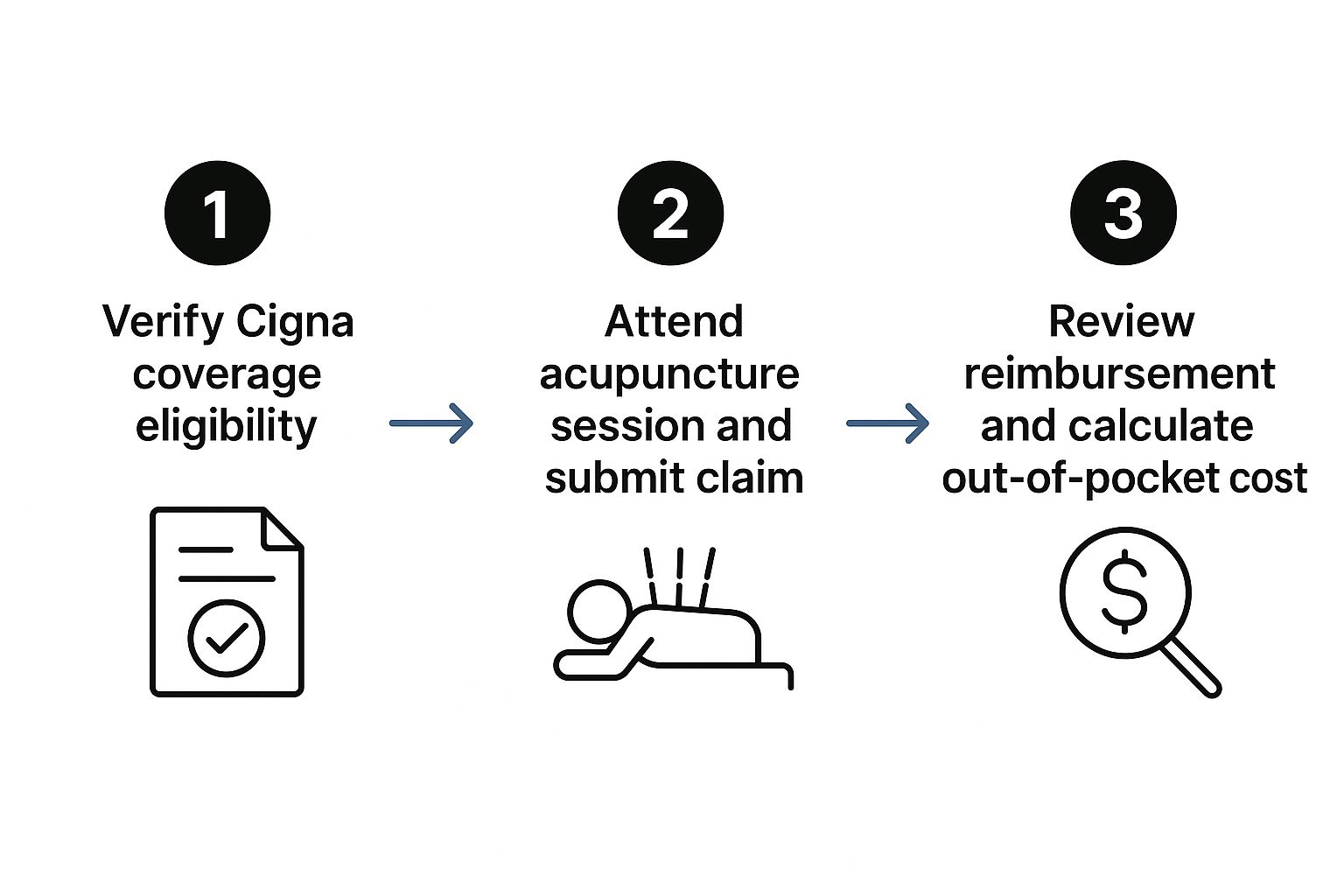

A Step-By-Step Guide to Verify Your Acupuncture Benefits

The last thing you want after a relaxing acupuncture session is a surprise bill. To sidestep any financial headaches, it’s best to get a clear picture of your coverage directly from Cigna before your first appointment. Think of it as doing a little homework upfront to ensure a smooth, stress-free experience.

The easiest place to start is your online member portal. Log in to your myCigna account and find the document called the "Summary of Benefits and Coverage" (SBC). This is essentially the rulebook for your specific plan. A quick search (Ctrl+F) for the word "acupuncture" will usually tell you if it’s a covered benefit. You'll also find key details here, like your copay, coinsurance, and annual deductible.

Calling Cigna for Confirmation

Your SBC gives you a great overview, but it might not spell out every single detail or limitation. That’s why your next move should be to call the member services number on the back of your insurance card. Speaking directly with a representative is the only way to get definitive answers tailored to you.

This chart gives you a bird's-eye view of the entire process, from that first verification call to getting your claim paid.

As you can see, confirming your benefits is the foundational step. It sets you up for a predictable and straightforward process from start to finish.

When you get a representative on the line, don’t just ask a simple "yes or no" question. The key is to dig into the specifics to uncover any potential roadblocks.

Pro Tip: Always get a reference number for the call and jot down the name of the person you spoke with. This simple step creates a paper trail that can be incredibly helpful if any questions come up later.

To get the clarity you need, here are the essential questions you should ask:

- Is acupuncture a covered benefit on my plan for a specific condition like chronic low back pain?

- Do I need a referral from my primary doctor or pre-authorization before I start treatment?

- How many acupuncture visits does my plan cover per year?

- What will my copayment or coinsurance be for each session?

- Have I met my annual deductible? If not, how much more do I have to pay out-of-pocket?

Getting answers to these questions empowers you to plan your treatment and budget with confidence. For a broader look at how different insurance carriers approach this, check out our general guide on whether acupuncture is covered by insurance.

Frequently Asked Questions About Cigna and Acupuncture

Insurance policies can be tricky, and when it comes to specific treatments like acupuncture, it's natural to have a few questions. Let's tackle some of the most common things people ask about their Cigna coverage.

Getting these details sorted out upfront can be the difference between a seamless experience and a surprise bill. A little preparation goes a long way in making sure you can focus on your treatment, not the paperwork.

Do I Need a Referral for Cigna Acupuncture Coverage?

This is a big one, and the answer hinges entirely on what kind of plan you have. Think of it this way: some plans have a "gatekeeper," and others don't.

If you have an HMO plan, your Primary Care Physician (PCP) is that gatekeeper. In nearly every case, you'll need a formal referral from your PCP before Cigna will even consider paying for acupuncture. Trying to skip this step is a surefire way to get your claim denied.

On the other hand, PPO plans are built for flexibility. They typically don't require you to get a referral to see a specialist, and that includes an acupuncturist in your network. It's a fantastic perk, but don't let that freedom fool you.

Even if a referral isn't needed, Cigna may still require pre-authorization for the treatment itself. This is a separate checkpoint where the insurance company must agree that the acupuncture is medically necessary before you start. Always call to confirm both.

How Do I Find an In-Network Acupuncturist?

Sticking with an in-network provider is your best bet for keeping costs down. Cigna has made finding one pretty simple.

Your most reliable resource is the provider directory on the myCigna website or their mobile app. Once you log in, you can search for specialists in your area and simply filter for "Acupuncturist." This will pull up a list of providers who are officially contracted with Cigna.

Here’s a quick rundown of the process:

- Step 1: Log into your personal myCigna portal.

- Step 2: Find the "Find Care & Costs" or a similarly named provider directory section.

- Step 3: Search for "Acupuncturist" and set your location.

- Step 4: Call the acupuncturist’s office to double-check that they accept your specific Cigna plan.

That last step is absolutely critical. A provider might be in some Cigna networks but not all of them, so a quick phone call can save you a major headache.

What Are Common Reasons for a Denied Claim?

It's frustrating, but even with an approval, a claim can still be denied. Knowing the common tripwires can help you avoid them.

The number one reason for a denial is a mismatch between your diagnosis and Cigna's criteria for "medical necessity." If you're seeking treatment for something Cigna doesn't consider a valid use for acupuncture—like general wellness—they're likely to reject the claim.

Other common pitfalls include:

- Exceeding Visit Limits: Many plans put a hard cap on the number of sessions they'll cover in a year.

- Authorization Issues: Forgetting to secure a required pre-authorization is an instant denial.

- Out-of-Network Provider: Seeing an acupuncturist outside your network when your plan doesn't include out-of-network benefits.

Knowing what to expect during your first acupuncture visit can also arm you with the right questions to ask your provider about treatment plans and how they code their claims.

At Eric Tsai Acupuncture and Herbs, we take the guesswork out of the equation. We offer a complimentary insurance verification service where we contact Cigna for you to get a clear picture of your benefits. That way, you can focus on your health, not on hold music.