So, is acupuncture covered by insurance? The simple answer is: it depends. While more and more plans are starting to cover it, coverage is far from guaranteed. It all comes down to the fine print of your specific insurance policy, where you live, and your medical diagnosis.

The Reality of Acupuncture Insurance Coverage

Think of insurance coverage for acupuncture like a patchwork quilt. The patterns are all over the place, and what's covered varies wildly from one policy to the next. A plan based in California might have generous benefits, while a nearly identical one from the same company in Texas might offer nothing at all. This inconsistency is where most of the confusion for patients comes from.

But there's good news. The landscape is definitely shifting in a positive direction. As more people turn to acupuncture for real relief from conditions like chronic pain, they're demanding that their insurance help cover the cost. This groundswell of patient advocacy is pushing insurers to take a closer look at their policies and add acupuncture to their list of covered services.

A Positive Trend in Coverage

Recent data confirms this encouraging trend. Between 2010 and 2019, the percentage of acupuncture visits with some insurance coverage jumped from 41.1% to 50.2% in the United States. In that same timeframe, the portion of costs paid by patients out-of-pocket actually went down. This shows that insurers are slowly but surely picking up more of the tab. You can dig into the specifics of these insurance coverage trends on the PMC website.

Even with this progress, it's crucial to be realistic. When a plan says it "covers" acupuncture, there are almost always strings attached. You might find limits on the number of visits per year, a requirement for a specific medical diagnosis to prove it's necessary, or rules dictating which acupuncturists you're allowed to see.

Understanding the factors that determine your benefits is the first step. It equips you to ask the right questions, so you can avoid surprise bills later on.

To help you get a handle on this, the table below breaks down what insurance companies look at when deciding whether to pay for your treatment.

Quick Guide to Acupuncture Coverage Factors

This table summarizes the primary elements that determine whether your acupuncture treatment will be covered by insurance.

| Factor | What It Means for Your Coverage | Example |

|---|---|---|

| Your Specific Plan | Not all plans from the same insurance company are created equal. An HMO often has different rules than a PPO. | A Blue Shield PPO might cover 12 visits a year, while their HMO plan might only cover 6 and require a referral first. |

| Medical Diagnosis | Coverage is almost always tied to a specific, recognized health condition. This is often called "medical necessity." | Insurers are far more likely to approve acupuncture for chronic low back pain than for general wellness or stress reduction. |

| State Regulations | Some states have laws or benchmark plans (under the ACA) that require certain insurance plans to include acupuncture benefits. | Marketplace plans in states like California or Maryland often cover acupuncture because of state-level requirements. |

| Provider Network | Your costs will be much lower if you see an "in-network" acupuncturist who has a contract with your insurance company. | Seeing an in-network provider might mean a simple $30 copay, but an out-of-network one could leave you paying the full session fee upfront. |

As you can see, it's not a simple "yes" or "no" question. The key is to look at your own situation through the lens of these factors. This will give you the best shot at getting the care you need with the least amount of financial stress.

Why Your Insurance Coverage Can Be Unpredictable

Ever tried to get a straight answer from your insurance company about acupuncture and felt like you were speaking another language? You’re not alone. The unpredictable nature of coverage often boils down to one critical concept that insurers live by: medical necessity.

Think of medical necessity as the gatekeeper for your benefits. For an insurer to approve a treatment, they have to agree it's essential for diagnosing or treating a specific, documented medical condition. They want proof that acupuncture isn't just for general wellness, but a targeted solution for a real health problem. This is exactly why coverage for chronic low back pain is far more common than for stress reduction.

The Role of Scientific Evidence

Insurance companies are, by their very nature, risk-averse. They feel most comfortable covering treatments that are backed by years of extensive scientific research and large-scale clinical trials. And while the body of evidence supporting acupuncture is growing every day, its journey into mainstream medical acceptance has been a bit slower than that of more conventional treatments.

This history plays a huge part in today's coverage gaps. For decades, therapies like acupuncture were labeled "alternative," placing them outside the established medical system and creating a much higher bar for acceptance.

Insurers prioritize conditions where acupuncture has a strong, proven track record. The more robust the scientific evidence for treating a specific ailment, the higher the likelihood of securing coverage for it.

For example, conditions with a wealth of positive studies—like chemotherapy-induced nausea or certain types of chronic pain—are much more likely to get the green light. On the other hand, getting coverage for conditions with emerging but less established evidence, like fertility support, can be a real challenge. This is also why so many patients have historically had to pay out-of-pocket. For a deeper look into this, check out our guide on how health insurance covers acupuncture.

Historical Context Matters

The path for complementary therapies like acupuncture has been an uphill one. Even as patient demand grew, insurance coverage lagged far behind. National data from 2002 to 2012 revealed that the vast majority of adults using acupuncture had little to no help from their insurance plans. In 2012, a mere 0.4% of adults who saw an acupuncturist had their visits fully covered. You can explore more about these early trends in acupuncture coverage on the CDC website.

This history helps explain the caution that still exists in the industry today. The good news is that as research continues to validate acupuncture’s effectiveness, and as major bodies like Medicare begin to offer coverage for specific conditions, those old walls are slowly coming down. Understanding this context helps you see why verifying your benefits is so crucial and gives you the knowledge to have a more informed conversation with your insurance provider.

How to Confirm Your Acupuncture Benefits Step by Step

Don't just assume your insurance plan covers acupuncture—that can be a recipe for a surprise bill down the line. The only way to know for certain if you have coverage is to verify your benefits directly with the insurance company. Taking this step beforehand means you can start your treatment with complete confidence and no financial guesswork.

Think of it as a quick investigative mission. It doesn't have to be a headache. With the right information in hand and a few key questions, you can get all the answers you need in one phone call.

Your Pre-Call Preparation

Before you dial, get your ducks in a row. Grab your insurance card, a pen and paper, or open a new document on your computer. You'll want to jot down the date of the call, the name of the representative you speak with, and any call reference number they give you.

This little bit of prep work makes the whole conversation smoother. It shows the representative you're prepared and ensures you have a record of all the important details. Trust me, having these notes can be incredibly helpful if you ever need to follow up.

Verifying your benefits isn’t just about getting a simple 'yes' or 'no.' It’s about digging into the specifics—the rules, limitations, and costs tied to your plan—so you can avoid any unpleasant surprises later.

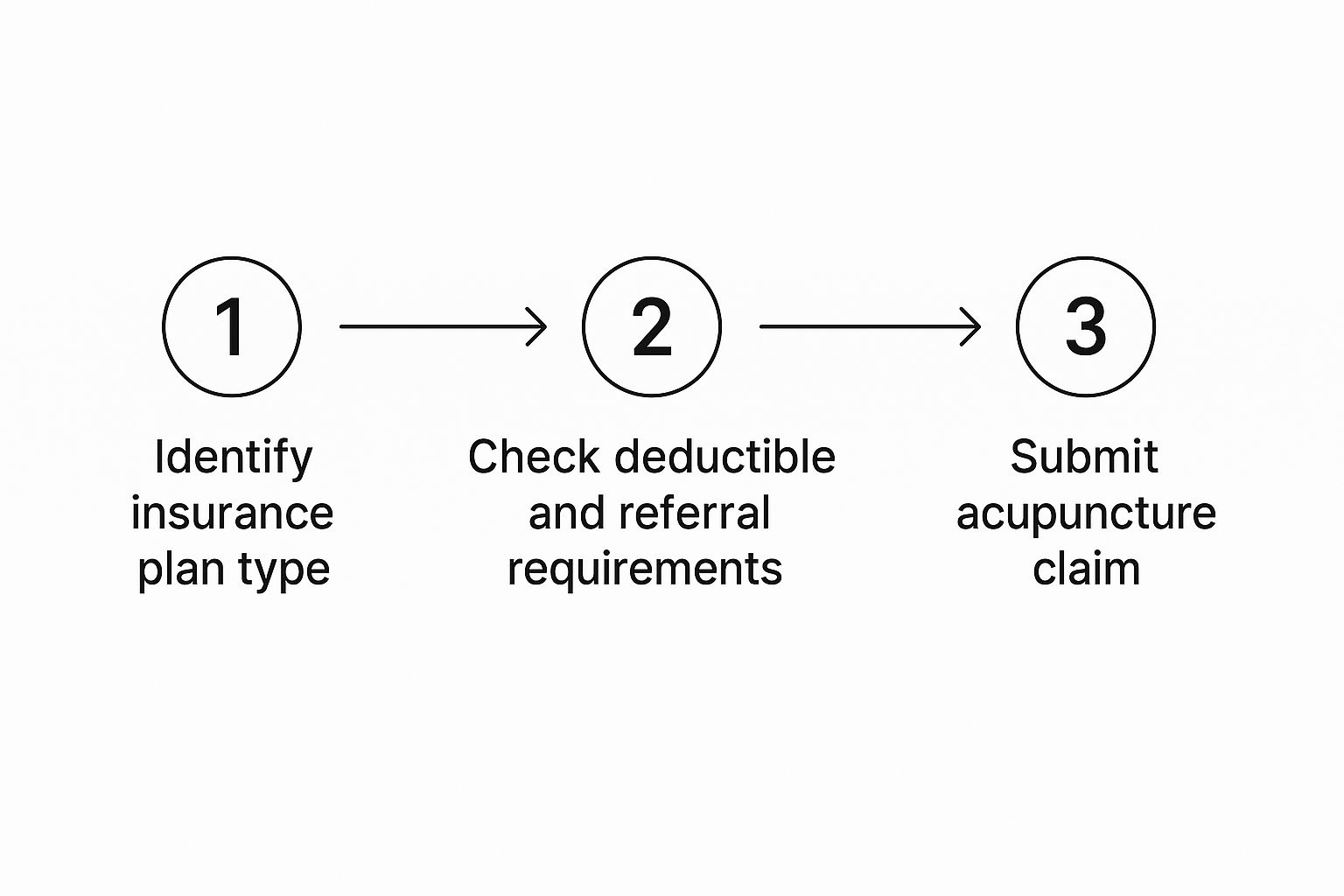

This graphic breaks down the typical journey of using your insurance for acupuncture, from the initial verification to getting your claim processed.

As you can see, figuring out your plan's details is the crucial first step. It sets the stage for everything else, like knowing your deductible and how to submit a claim correctly.

The Essential Questions to Ask

Once you have a representative on the line, it’s time to get specific. Here’s a checklist to guide you through the conversation and get the clear answers you need.

-

"Do I have acupuncture benefits on my current plan?" This is the first and most important question. Just get a straight yes or no.

-

"What specific conditions or diagnoses are covered?" This is a big one. Insurance companies often only cover acupuncture for certain ICD-10 codes, like chronic low back pain (M54.5). You need to know if your health concern is on their approved list.

-

"Do I need a referral from my primary care physician (PCP) or pre-authorization?" Many claims get denied simply because this step was missed. It's critical to know if you need a doctor's referral or prior approval from the insurer before you start treatment.

-

"Is there a limit on the number of visits per year?" Most plans that offer acupuncture benefits will cap the number of sessions they'll pay for, often at 12 or 20 visits per calendar year.

-

"What are my out-of-pocket costs?" Ask about your deductible, copay, and coinsurance as they apply to acupuncture. Make sure to ask for the costs for both in-network and out-of-network providers, as they can be very different.

Asking these direct questions will give you a complete picture of what to expect. For a deeper dive into this process, check out our full guide on how to confirm your acupuncture benefits. Once you have these answers, you can schedule your first appointment feeling fully prepared and in control of your healthcare costs.

How Major Insurance Providers Handle Acupuncture

While the fine print on every individual plan is different, you can get a solid idea of your potential coverage by understanding the general policies of the major carriers. Seeing how these large public and private insurers approach acupuncture helps you set realistic expectations before you even pick up the phone.

Navigating the world of insurance can feel like trying to solve a puzzle with pieces from a dozen different boxes. A plan from one company might offer robust acupuncture benefits, while another from that same company offers none. Let’s break down the typical stances of the biggest names in the industry.

Medicare and Medicaid: A Changing Landscape

Medicare, the federal health insurance program for folks 65 or older, made a pretty significant policy change back in 2020. This kind of decision often sends ripples through the industry, influencing how private insurers shape their own benefits, making it a critical development for acupuncture access.

In what was a landmark move, Medicare now covers acupuncture for a very specific condition: chronic low back pain. This was a major step forward, finally acknowledging acupuncture as a legitimate, evidence-based treatment for one of the most common and debilitating ailments.

The rules, however, are quite strict. To qualify for coverage, the treatment must be for chronic low back pain that has lasted 12 weeks or longer. The treatment also has to be administered by a licensed acupuncturist who is supervised by a physician, physician assistant, or nurse practitioner. Under these guidelines, Medicare allows for up to 12 visits in 90 days, with a possible extension to 20 visits if you're showing clear improvement.

Medicaid, on the other hand, is managed state by state, so there’s no single national policy. Coverage is entirely dependent on where you live. For a closer look at the different factors that influence insurance coverage, you can explore our guide on whether acupuncture is covered by insurance.

Private Insurers: A Mixed Bag

For those with private insurance, the answer to is acupuncture covered by insurance is even more of a mixed bag. Coverage depends entirely on the specific plan you or your employer selected. Here's a quick rundown of some of the major players:

- Blue Cross Blue Shield (BCBS): As an association of independent companies, BCBS policies vary a great deal from state to state. Many plans do offer benefits for pain-related conditions like back pain, neck pain, and headaches, but you absolutely have to verify the specifics of your regional plan.

- Aetna: Aetna often covers acupuncture for pain management, nausea, and other specific diagnoses. They typically require pre-authorization before you start treatment and may limit the number of sessions you can have each year.

- Cigna: Much like Aetna, Cigna generally covers acupuncture for treatments deemed medically necessary, usually focusing on pain relief for conditions like migraines and low back pain.

- UnitedHealthcare (UHC): UHC provides coverage under many of its plans, but it’s almost always tied to a specific medical diagnosis. Pain conditions are the most likely to be approved for treatment.

It's worth noting that several states have proactively woven acupuncture into their healthcare frameworks. States like California, Maryland, Washington, and Oregon have adopted policies that provide acupuncture benefits for certain conditions under Medicaid and Affordable Care Act plans, which has really expanded access for many residents. The key takeaway is simple: always verify your benefits directly with your insurance provider.

Choosing Between In-Network and Out-of-Network Acupuncturists

So, you’ve confirmed your plan has acupuncture benefits. That’s a great first step! Now comes the most important decision for your wallet: choosing between an in-network and an out-of-network provider. This single choice can be the difference between a predictable copay and a surprisingly large bill.

Think of it like using your bank's ATM versus a random one at a convenience store. Using your own bank’s machine is cheap, maybe even free. But use the other guy's, and you’re suddenly hit with fees from both sides. Insurance networks operate on a very similar principle.

The Financial Benefits of Staying In-Network

An in-network provider is simply an acupuncturist who has a contract with your insurance company. By signing that contract, they've agreed to accept a specific, discounted rate for their services. For you, this means predictable, lower costs.

Once you’ve met your annual deductible, you’ll typically just pay a flat copay for each visit. This is, without a doubt, your most affordable path to treatment.

Finding an in-network acupuncturist is usually straightforward. The best place to start is your insurer’s own provider directory, which you can find on their website or mobile app.

Here’s how to track one down:

- Log into your insurance company's member portal.

- Look for a "Find a Doctor" or "Provider Directory" link.

- Filter the search for "Acupuncturist" or a similar specialist.

- Enter your zip code to get a list of approved practitioners in your area.

Sticking with an in-network acupuncturist is the simplest and most cost-effective approach. They handle the billing directly with the insurance company, leaving you responsible only for your copay or coinsurance.

When You Choose an Out-of-Network Provider

What happens if the acupuncturist you want to see isn't in your plan's network? This is where things can get a bit more complex and, frankly, more expensive. An out-of-network provider has no contract with your insurer, so they haven't agreed to any discounted fees. You'll be expected to pay their full rate directly at the time of your appointment.

However, you might be able to get some of that money back. If your plan offers out-of-network benefits, you can file a claim for reimbursement yourself.

To do this, you’ll need to ask your acupuncturist for a superbill. This is essentially a detailed medical receipt that includes all the specific diagnosis and treatment codes your insurance company needs to process a claim. You then submit this document to your insurer and wait. If approved, they’ll mail you a check for whatever portion of the bill they cover—but be prepared for the reimbursement to be significantly less than what you’d get with an in-network provider.

Common Questions About Acupuncture and Insurance

Even with a roadmap, navigating the world of health insurance can leave you with a few lingering questions. That's perfectly normal. Getting straight answers is the best way to feel confident about your healthcare choices, so let's tackle some of the most common questions patients ask about acupuncture coverage.

Think of this as your personal cheat sheet for understanding the finer points. With the right information, that insurance maze starts to look a lot more manageable.

What Conditions Does Insurance Usually Cover?

When patients ask, "is acupuncture covered by insurance," the real question is often, "is it covered for my condition?" Insurers are creatures of habit and data. They're far more likely to cover treatments for conditions where the evidence is overwhelming, especially when it comes to pain management.

Chronic low back pain is the heavyweight champion of covered conditions, a status solidified when Medicare expanded its coverage back in 2020. Beyond that, you'll often find coverage for:

- Persistent neck pain

- Migraines and recurring tension headaches

- Nausea, particularly from chemotherapy or pregnancy

- Pain associated with arthritis

What about things like infertility, anxiety, or digestive problems? That's where it gets tricky. Coverage for these issues is much less consistent and really depends on the specific details of your plan. This is why you absolutely must confirm that your diagnosis is on your insurer's approved list before you start treatment. A 2019 study revealed that less than 2% of people with low back pain actually got reimbursed for acupuncture, which just goes to show how vital it is to verify your benefits ahead of time.

What Is a Superbill and How Does It Work?

If your acupuncturist is out-of-network, the superbill becomes your best friend. Simply put, it's a special, itemized receipt created for one purpose: to get you reimbursed by your insurance company. It contains every piece of information they need to process your claim.

A proper superbill will always include:

- Your acupuncturist’s name, license number, and office details.

- The official diagnosis codes for your condition (called ICD-10 codes).

- The specific codes for the treatments you received (these are CPT codes).

Think of a superbill as your key to unlocking out-of-network benefits. You pay your provider directly, submit their superbill to your insurer, and get paid back.

Once you send it in, your insurance company treats it just like any other claim. If your plan has out-of-network benefits, they'll process it and mail you a check for whatever portion of the cost your plan covers. It’s a straightforward way to see the provider you want, even if they aren't on your insurance company's preferred list.

Does the Affordable Care Act Require Insurers to Cover Acupuncture?

This is a common point of confusion. The short answer is no; the Affordable Care Act (ACA) does not have a nationwide rule forcing every plan to cover acupuncture.

What the ACA did was create a set of 10 Essential Health Benefits (EHBs) that most plans have to cover. However, it left it up to each individual state to define what those benefits include by choosing a "benchmark" plan.

This creates a patchwork of coverage across the country. If you live in a state like California, Maryland, or Oregon, where the state's benchmark plan happens to include acupuncture, then all ACA plans sold there must cover it, too.

But in states where the benchmark plan doesn't include acupuncture, there's no such requirement. It’s left entirely to the discretion of each insurance company. This state-by-state difference is precisely why you can't assume anything—you have to check the fine print of your own policy.

At Eric Tsai Acupuncture and Herbs, we know firsthand how confusing insurance can be. That's why we offer a complimentary benefit check to give you a clear picture of your coverage. Schedule a consultation today and let us help you start your journey toward balanced health and wellness.